I drove the 3.5-hour route to see my mother last weekend. In preparation, I decided to fill my little tank the night before. And besides, I thought, prices are likely to be higher tomorrow. It was $4.149 per gallon. The next day, about 45 miles down the road on I-90 in Southern Minnesota, Love’s posted price was $4.599. WHAT? I thought I slept through a timewarp, but it was confirmed by sign after sign.

Petty Games

How are you dealing with high energy prices? I have filled my tanks on multiple occasions before I otherwise would in order to buy at a lower cost. One time I purchased early for a psychological mind trick to keep the total charge lower – like the salty snack makers that put 14 fewer potato chips in each bag. This is ridonculous!

I am also driving a smidge slower, especially with a headwind. I mentioned last week that I can see instantaneous mileage and cumulative trip mileage, and I’ve become a slave to those readouts.

Non-Energy Benefits, NEBs

Slowing down may have non-energy benefits. The last time I drove to Mom’s, a red pickup truck passed me about a mile before we drove past a state trooper parked in the median. I thought, “I’m fine. I’m not the fastest driver out here.” Nope. A few minutes later, the trooper is behind me. I pulled into the right lane, and he followed. Damn! I think it was my car, but once he saw the gray-haired coot behind the wheel and I told him I was going to see my mother (he asked), pfft, I was off footloose and fancy-free. Driving a few ticks slower will help avoid those risks – NEBs.

Energy Benefits

Example: If I drive 210 miles @ 73 mph and 36 mpg, at $4.60 per gallon, I save a whopping $2.44 compared to 80 mph and 33 mpg. That computes to less than $10 per hour for my time—$ 2.44. I would have to keep driving to save enough for a small Jack’s Link. The more you spend, the more you save!

However, say you’re driving a gas-guzzling large SUV or pickup truck, and you improve mileage by three from 18 mpg to 21 mpg on the same trip. Savings = $7.67 and over $30 per hour of your time. That might get you a Happy Meal or a decent pint of beer.

Gasoline Prices v Oil Prices

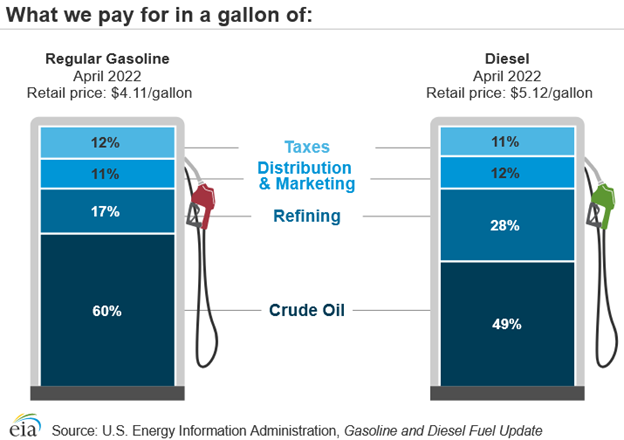

Why do gas prices move in lockstep with oil prices in real-time? First, if you want to see that this is the case, you can see Friday’s spot prices of NYMEX crude and gasoline[1], year to date, in the next couple of charts[2]. Now that, as they say, is a chip off the block. The shapes are nearly identical, but gasoline almost doubled while oil went up only a smidge over 50% in the same period. Why is that?

Per the Energy Information Administration, crude makes up only about half the gasoline and diesel fuel prices. My guess is that diesel costs more to refine to take out the sulfur, and it is a heavier fuel that requires more energy extract from crude[3].

If the cost of gasoline or diesel moved on a dollar basis with the price of crude, the ratio of costs would be reversed. In other words, with a rise of 50% in the cost of oil, gasoline and diesel fuel should increase 25% rather than 100%. Something else is at play, but why does gasoline react so strongly to changes in crude prices?

If the cost of gasoline or diesel moved on a dollar basis with the price of crude, the ratio of costs would be reversed. In other words, with a rise of 50% in the cost of oil, gasoline and diesel fuel should increase 25% rather than 100%. Something else is at play, but why does gasoline react so strongly to changes in crude prices?

And another thing, it takes a while for gasoline to make its way from the refinery to the retail gas station. Why does the price change at the gas station when oil jumps from $118 to $122 per barrel, and the cost of the oil to produce the stuff in the underground gas-station tanks was made with $105 oil? To answer this, I’m going offroad because I doubt I’ll find a better answer on the innertube.

First, the energy cost is inelastic until prices reach extreme levels. People need to go to work, get groceries, haul the kids, etc. They’re not going to change that until energy prices really take a bite as a percentage of their income. Second, gasoline itself is a commodity, indistinguishable from other gasoline despite the BS gas stations say about “their” gasoline. It is also storable and non-perishable. Compare that to a loaf of Sara Lee bread. That has to sell in a day or two, and you can buy the store-labeled stuff made in the same bakery (yes, it’s true) for half the price. There are alternatives for bread, but not gasoline.

I looked for professional input on the price of gasoline versus crude oil. The Wall Street Journal published an interview transcript, apparently from the lips of an expert. Said expert, Collin Eaton, stated, “Most gas stations in the US are operated independently, and those companies have to make up for margins that they lost when oil prices rose initially.” Uh, no, Collin. Look at the data.

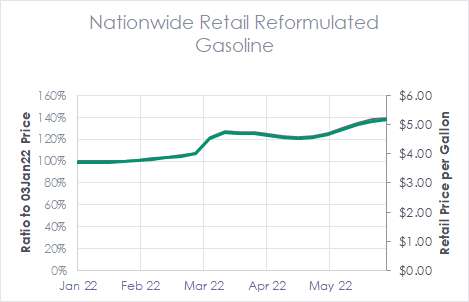

Then I thought maybe those charts above are the commodity and not retail prices. Ok. So, what do the retail prices look like? The next chart shows nationwide reformulated retail prices through the end of May. The price curve takes the same shape as the NYMEX crude and gasoline charts. However, while NYMEX gasoline prices are up 91%, YTD, retail is up only 39%, YTD. NYMEX crude is up 58%, YTD.

Quarter Conclusion

Quarter Conclusion

NYMEX crude oil, RBOB gasoline, and retail gasoline move in lockstep but with different pricing ratios. Why? I don’t know. I’ll figure it out for next time, maybe.

In the meantime, the chart below shows historic nationwide gasoline prices since 1994. Enjoy!

[1] From The Wall Street Journal. RBOB = reformulated something oxygenated blend, blah, blah

[2] Russia’s invasion of Ukraine has had no lasting impact. There was price jump that quickly disappeared after the war broke out in early March.

Quarter Conclusion

Quarter Conclusion