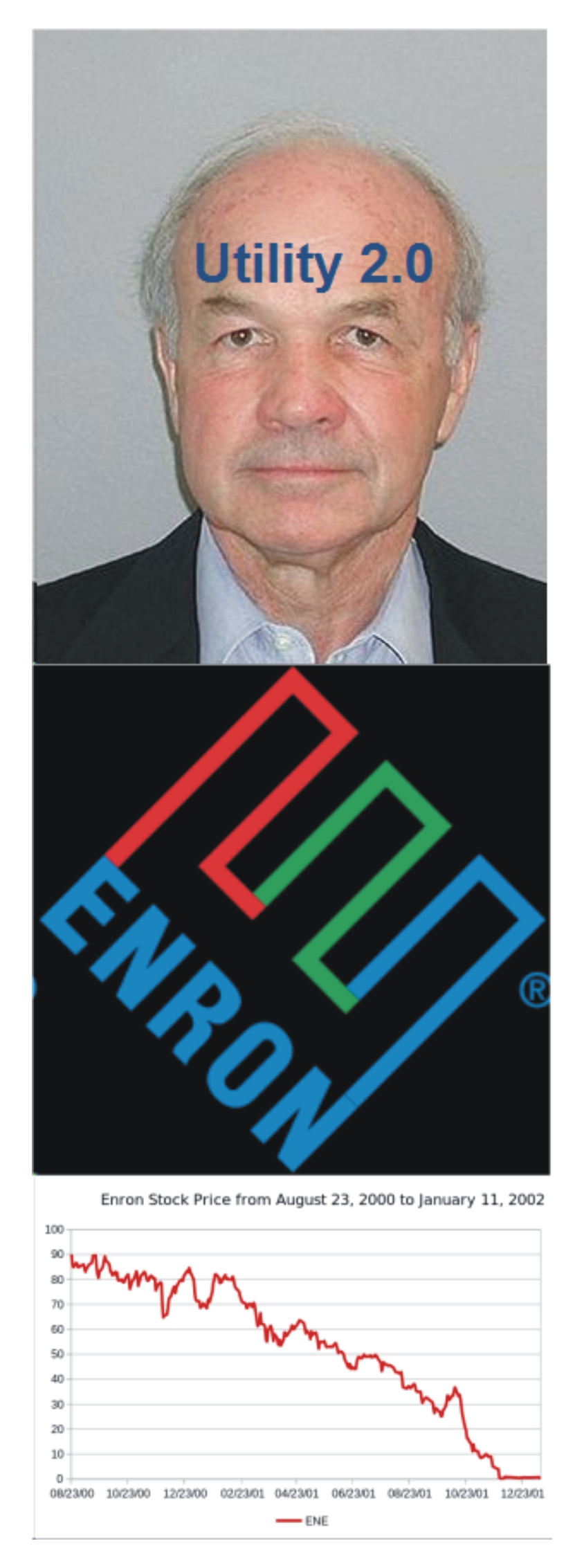

As I read in The Wall Street Journal last week, I would like to disrupt the use of the overused buzzword disruption and the use of buzzwords in general, but I gotta do what I gotta do – talk about Utility 2.0 again. Come to think of it, the utility industry, and those that supported it, must have been asleep at the wheel in the 1990s. That was Utility 2.0 – deregulation, which didn’t work out so well with widespread bankruptcies, some of which exist to this day. Utility 2.0 gave rise to hucksters like Jeffrey Skilling and Ken Lay of Enron, which bankrupted the California utilities and the mega consulting firm formerly known as Anderson Consulting. Anderson reemerged as Accenture, which charges exorbitant fees for management CONsulting. That aside, let’s hope new Utility 2.0 is not the colossal bomb that was old Utility 2.0.

The last word on 2.0: it goes to show how unhip our industry is that we discovered this buzzword in 2015ish. The Madison-Wisconsin-based band Garbage titled its second album 2.0 in 1998. Those who were once just a twinkle in their parents’ eyes are attending college before we can catch up to cool.

Utility 3.0

Utility 3.0 will be a battle between vertically integrated / fully regulated utilities, the regulated pieces (transmission and distribution) of deregulated utilities, intervenors, third party suppliers, and regulators.

One battle will be pricing electricity delivered by distributed energy resources including solar and standby generators used for demand response. The average price to produce kWh is practically irrelevant. When the kWh can be supplied is everything. For example, dividing the levelized cost of wind resources by kWh produced only tells a tiny bit of the story. What is a kW worth on a cold dark Monday morning in a winter-peaking region while the wind isn’t blowing? The general public, and certainly politicians, don’t get this at all.

As far as efficiency and demand side management is concerned, these too will go the way of local distributed energy resources. This is already occurring in the Northeast. Consolidated Edison has the Brooklyn Queens Demand Management project. National Grid in upstate New York is similarly beginning to deploy localized solutions to avoid specific conventional supply side resources including construction of expensive substations.

In other words, very localized energy efficiency, demand response, and distributed energy resources are being evaluated as a direct alternative to million/billion dollar upgrades to transmission systems and substations.

These projects, also known as non-wire alternatives, or NWAs, are being launched as part of New York’s Reforming the Energy Vision, or REV.

This brings me round to last week’s post; specifically, grilling sacred-cow burgers. These sacred cows roam the prairies of old-school regulatory mentality where utilities were vertically integrated and unchallenged by solar-panel owners who think they deserve retail rates Sunday morning when capacity exceeds demand by about 8:1.

Pricing Energy Efficiency and Demand Response

Last week I suggested, why not share the wealth and allow utilities to capitalize on energy savings? The cost of energy saved is much cheaper than energy supplied, on a levelized basis – which means, over the lifetimes of these alternatives. Utilities earning close to their weighted cost of capital is a 30 year old concept here in the Midwest, as mentioned last week. It is being discovered again in the Northeast, at least in the state of New York.

I referenced Northeast Energy Efficiency Partnership’s (NEEP) recent report, Next Generation Energy Efficiency. Number three, on the list of ten items in the report, explains the following to help (open minded) policy makers keep their states at the forefront:

Create utility rate structures aligned with broader public policy goals, including mitigating the need for new infrastructure, lowering peak and overall energy use, supporting carbon reduction goals, fostering climate resiliency, growing the clean energy economy, and helping consumers save energy and reduce costs.

If we are going to do this, we need to provide carrots[1] to utilities. According to the aforementioned NEEP report, New York’s REV:

- Allows the costs of deploying efficiency, demand response, and distributed energy resources to be recovered through Con Edison’s (or any other utility in the state) rate base. It would be similar to the utility’s overall rate of return (how ‘bout those bananas).

- Allows for a bonus of 100 basis points (one percentage point total) on rate of return as follows:

- 45 points for achieving or exceeding the 41 MW (or other specified MW) target

- 25 points for achieving “diversified” distributed energy providers

- 30 points for achieving a lower $/MW value than the conventional alternative – the whole point of the experiment

I must say, on that last point, the NWA costs versus conventional upgrade cost does not include the cost of avoided generation. I.e., if there were ten of these projects, construction of a good size utility scale power plant is avoided. That avoided cost does not appear to be factored into the equation. Therefore, if the NWA cost is less, it would really be a victory for NWAs and the utility! I would say that is something we can all get behind. Well maybe not the cowboys protecting the sacred cows.

[1] As opposed to “incentives” which connotes money for nothing and baby birds for free.