I spent last week in California, where the energy transition is being jammed at a breakneck pace like a square peg in a round hole. I’ll set the stage with just a few things.

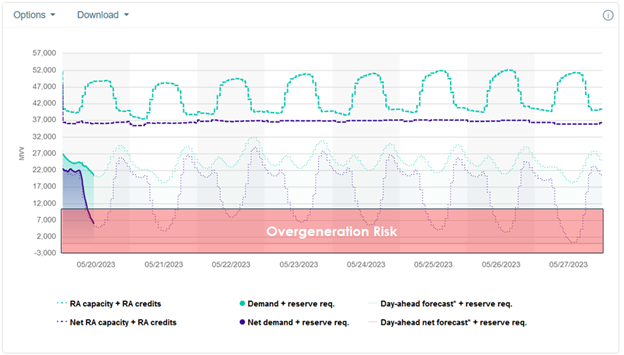

First, the duck curve, a feature of excessive solar generation that began overgenerating a year or two ago, is now the “canyon” curve. Overgeneration occurs around 10 GW of net load – the amount needed to keep hot resources spinning in case of a fault in the system[1]. The image below shows the current and forecast net loads on CAISO as of Saturday, May 20, 2023.

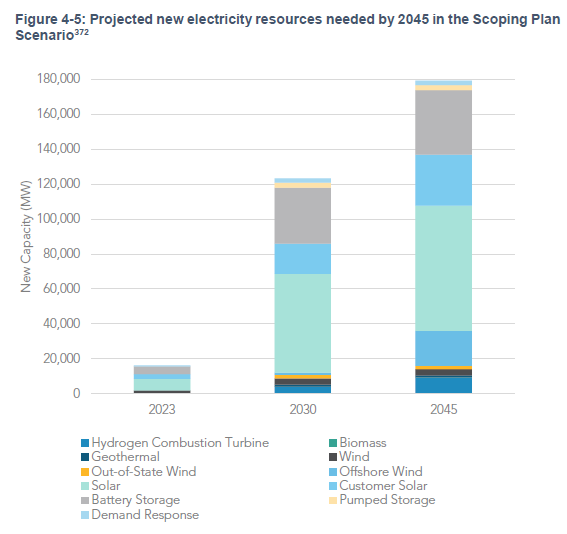

But this is just the beginning. The California Air Resources Board’s 2022 Scoping Study targets an additional 60 GW (60,000 MW on the above chart) of solar by 2030. Seven years! Canyon? I may apply to copyright “the mantle curve.”

But this is just the beginning. The California Air Resources Board’s 2022 Scoping Study targets an additional 60 GW (60,000 MW on the above chart) of solar by 2030. Seven years! Canyon? I may apply to copyright “the mantle curve.”

The plan is to add 75 GW of solar and 37 GW of battery storage by 2045. That’s not enough storage because a typical grid load factor is about 50%, but solar has a capacity factor of about 25%. Therefore, battery capacity needs to expand in lockstep with solar, GW for GW.

The plan is to add 75 GW of solar and 37 GW of battery storage by 2045. That’s not enough storage because a typical grid load factor is about 50%, but solar has a capacity factor of about 25%. Therefore, battery capacity needs to expand in lockstep with solar, GW for GW.

Second, a ban on internal combustion engines for light-duty vehicles is coming in a mere 12 years. California has accumulated the most EVs of any state in the United States – nearly as much as the rest of the country combined. Electric vehicles account for 17.5% of new vehicle sales in California and represent about 6.3% of light vehicles on the road.

Second, a ban on internal combustion engines for light-duty vehicles is coming in a mere 12 years. California has accumulated the most EVs of any state in the United States – nearly as much as the rest of the country combined. Electric vehicles account for 17.5% of new vehicle sales in California and represent about 6.3% of light vehicles on the road.

Third, a few weeks ago, California laid down a ban on the sale of new diesel trucks by 2036. I wonder where used trucks will migrate… By 2050, there will be a lot of hungry people because diesel fuel (tractors, harvest equipment, and over-the-road trucking), and fuel oil (ships), powers it all.

Fourth, the state’s remaining nuclear plant at Diablo Canyon is scheduled to shut down by 2030. It got an extension earlier this year after the Nuclear Regulatory Commission rejected the request last year. What changed? The NRC’s approval gives California five extra years of 2 gigawatts of baseload supply. I suggest spinning up replacements.

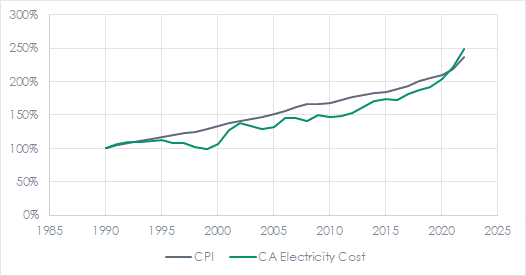

Fifth, after decades of electricity prices growing at or below the pace of inflation, in recent years, that appears to be in California’s rearview mirror[2],[3],[4]. More than one Microgrid 2023 Conference goers lamented, “Prices are rising faster than inflation while reliability is declining.” Uh-huh.

Ok, that’s enough for now. Let’s get into it.

Ok, that’s enough for now. Let’s get into it.

Step One, Behind-the-Meter Storage

Utility-scale centralized energy storage is the high-hanging, get-a-cherry-picker fruit. The much cheaper resource is distributed behind-the-meter (BTM) storage. Why behind the meter? Because it eliminates the need for billions and billions of dollars to upgrade congested transmission, distribution, substation, and last-step transformers. The grid needs load in the belly of the duck. The way to get it is storage BTM – batteries in garages for cars, thermal storage for cooling, heating, and refrigeration for all those loads.

If you think the 405 is congested, that will be a dam break compared to even a moderately electrified transportation sector. By the way, does this antiquated transmission system below look capable of charging millions of Teslas?

Millions of people come to Southern California for Disneyland. I prefer this spot on the 405 in Torrance, with possibly the world’s most congested transmission corridor, including WWII-era towers. Does that look worthy of delivering all-at-once charging at home at night? From where would that electricity come?

Millions of people come to Southern California for Disneyland. I prefer this spot on the 405 in Torrance, with possibly the world’s most congested transmission corridor, including WWII-era towers. Does that look worthy of delivering all-at-once charging at home at night? From where would that electricity come?

Think of the hassle of replacing or building this out. There will be pissing matches galore, adding twenty years to the transition. The cost would be astronomical. There’s a better way: behind-the-meter.

Step Two, Not Lithium Ion

The CPUC has acknowledged that lithium-ion is a bridge battery technology. “Lithium Ion will not be the predominant storage technology in five years on the grid because it is not environmentally safe. We will be implementing new technologies – yes, we know this works, but we need to innovate[5].”

Step Three, Massive Imports of Resources and Brainpower

The engineering and capital requirements for this hasty transition are immense, not unlike spinning up arms and troops after December 7, 1941. California cannot afford to pick winners and losers based on demographics or geographics; they must import labor and materials from all over the world in exchange for dollars. We can help with that.

Step Four, Regulatory and Incentive Reform (beyond CA)

Learning and tracking policies in California is more than a full-time job, so I cannot speak for needs there. However, I can speak for other places and other people. Most speakers and issues discussed at last week’s Microgrid Conference were from California. One such person said, “Utilities are incentivized to do wrong things.” Boy, I’ll say. Check out FERC Commissioner Danly’s testimony as one example. I’ll commit a separate post along those lines, but for now, utilities are incentivized for return on capital, which means building things and harvesting tax credits. The math is left to the reader.

Beyond that, the transition needs sharply more-aggressive rates for time of use, peak, super peak, and critical peak pricing. Energy charges may disappear entirely or be greatly reduced to reflect the average cost of fuel for delivered kWh. The cost of service (poles, wires, meter, operations, and maintenance) should be fixed. I can hear the howls of unfairness already. Do you want fairness or an energy transition? Fairness equals no change, and that will not work.

[1] FERC Commissioner, James Danly https://www.energy.senate.gov/hearings/2023/5/full-committee-hearing-to-conduct-oversight-of-ferc\

[2] https://data.bls.gov/pdq/SurveyOutputServlet

[3] https://www.eia.gov/electricity/sales_revenue_price/

[4] https://www.statista.com/statistics/630090/states-with-the-average-electricity-price-for-the-residential-sector-in-the-us/

[5] Panelist, California Clean Energy Procurement Conference, May 2, 2023