I’m just a mechanical systems[1] engineer but assume for a moment that I was a structural or civil engineer, and you asked me what it would take to build a bridge from Los Angeles to Honolulu. We can build anything, including that bridge. If the Golden Gate Bridge could be built in the 1930s, a nuclear submarine in the 1950s, and we put a man on the moon in the 1960s, we can sure as heck build a bridge to Hawaii in the 2020s. The bridge would be easier than zeroing out carbon emissions from the energy sector. See, I’m just an engineer. You ask me for something, and I’ll start loading the “here’s what you have to do-zz.” That is what our decarb course is about – coming again this fall. Look for it.

The Market Gives, The Market Takes

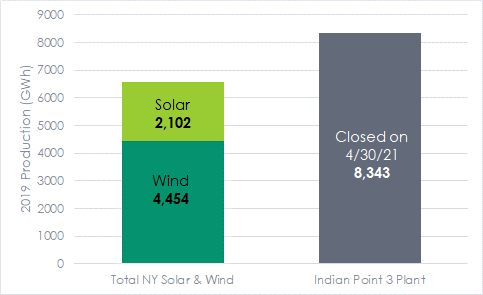

As noted in this blog many times and in the decarb course, carbon reduction progress to date has been driven by market forces and the arena in which those forces act (regulation and policy). You know the drill – cheap natural gas has displaced a lot of Appalachian coal consumption, and production and investment tax credits have helped drive down the cost of zero-emission renewables. But we may be near the nadir of carbon intensity as renewables drive other zero-emission producers out of the market. Those would be nuclear power plants. Here is a teaser from our decarb course to demonstrate:

Boom. On one New York day, closing one nuclear plant took out more zero-carbon kilowatt-hours than all renewable energy generation in the state combined. What the market and the arena give, the market takes away. There are massive quantities of carbon-free nuclear kWh on the block in the coming decade. This is a prime example of market forces and policy taking back carbon reduction – i.e., increasing CO2 emissions.

Boom. On one New York day, closing one nuclear plant took out more zero-carbon kilowatt-hours than all renewable energy generation in the state combined. What the market and the arena give, the market takes away. There are massive quantities of carbon-free nuclear kWh on the block in the coming decade. This is a prime example of market forces and policy taking back carbon reduction – i.e., increasing CO2 emissions.

Investing in Sustainability

The above market and policy talk sets the stage for the guest of this post, Tariq Fancy – BlackRock’s former Chief Investment Officer – for shifting their massive portfolio to one of sustainable investment to mitigate climate risk. His conclusion: “This is definitely not going to work,” per an article in The Guardian. He writes, “the climate crisis can never be solved by today’s free markets” because “[Institutional] investors have a fiduciary duty to maximize returns to their clients and as long as there is money to be made in activities that contribute to global warming, no amount of rhetoric about the need for sustainable investing will change that.”

That doesn’t mean investing in green technologies can’t be profitable, because as I learned in Personal Finance in college, a stock price is what someone else is willing to pay for it. Nothing else matters. Nothing.

He goes on, “In many cases it’s cheaper and easier to market yourself as green rather than do the long tail work of actually improving your sustainability profile.” Is the plastic straw thing over yet? Mom and I just enjoyed A&W root beer floats last week, and we used (gasp) plastic straws! I didn’t realize that until four days hence. That was sequestered carbon on its way to a landfill somewhere. Humbly speaking, if plastic straws is the best your strategy department can bring to the table, I would find some new strategists.

These things will have short-term impacts on investor choice as people move away from fossil fuel companies, petroleum refiners, and exploration and drilling companies into solar panels, wind turbines, and of course, Tesla. Once those adjustments are made, market forces and fundamentals will drive stock prices over the long haul (decades). As Fancy says, “If you sell your stock in a company that has a high emissions footprint, it doesn’t matter. The company still exists; the only difference is that you don’t own them. The company is going to keep on going the way they were and there are 20 hedge funds who will buy that stock overnight.” In other words, selling and putting downward pressure on it creates an opportunity for someone else.

Carbon Tax

Fancy suggests the best option is to lobby your congressperson for a carbon tax to reduce GHG emissions. I’m not going to dive into carbon taxes right here, but I would mention a couple of points about that. First, it is probably the simplest and fairest, which doesn’t lend itself to be a solution in Washington. Some companies get whacked a little while no one makes out like a bandit. The lack of quid pro quo opportunities decrease the likelihood of passing.

And, as I said a few weeks ago, Civics Lessons for Federal Carbon Policymaking, the last thing congresspeople want to do is put themselves on record for something like a carbon tax[2][3].

Bonus

Energy Central reposted this Guardian article. Check out the comments for some feisty exchanges. Raarr.

[1] I inserted “systems” because that’s the way I think. I don’t reduce things to isolated components because the world doesn’t work that way.

[2] Who killed the carbon tax, Democrats or Republicans?

[3] Carbon Tax Sidelined in Biden’s Push on Climate, Taxes