Saving the best for last, there was a session at the Mid-America Regulatory Conference entitled Nuclear, Go Small or Go Home. I could call that false advertising because there was almost no discussion on SMRs, or small modular reactors. Only a University of Illinois-Champaign researcher panelist mentioned SMRs. Why might this be? The freeze on nuclear power is thawing, brought to you, in part, by Springfield. Are SMRs the answer? We shall see a little bit in this Rant post. Long term, time will tell.

Nuclear Power and Public Opinion

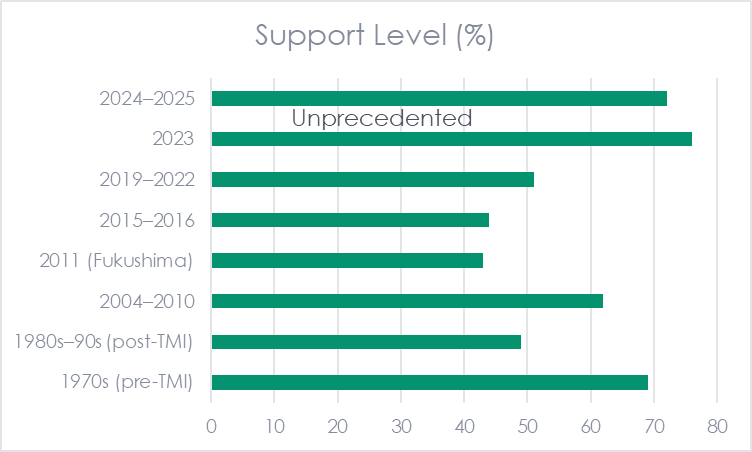

Suzie Jaworowski, Indiana’s Secretary of Energy, said nuclear power has an unprecedented (remember that?) 61% favorability rating. Where did that come from? Is it true? What are the trends? The Rant delivers. Figure 1 shows an AI-generated composite favorability assessment over the last 50+ years. Most recent data can be found at Bosconti (not to be confused with a twice-baked Italian cookie) Research.

Figure 1 U.S. National Nuclear Energy Public Opinion

Nuclear’s favorability hit nadir after Fukushima (not even Three Mile Island (TMI) did sentiment drop this low), a nuclear accident that killed no one and an accident that can be easily prevented using forces of nature to cool the reactor and prevent fuel damage with no external power whatsoever. I guess that sentiment is rising because politicians are learning that intermittent wind and solar are insufficient. The public wants zero-carbon energy without looking at landscapes of windmills and seas of solar panels.

Nuclear’s favorability hit nadir after Fukushima (not even Three Mile Island (TMI) did sentiment drop this low), a nuclear accident that killed no one and an accident that can be easily prevented using forces of nature to cool the reactor and prevent fuel damage with no external power whatsoever. I guess that sentiment is rising because politicians are learning that intermittent wind and solar are insufficient. The public wants zero-carbon energy without looking at landscapes of windmills and seas of solar panels.

Waste Issues

Markus Hawkins, Commissioner with the Public Service Commission of Wisconsin, reminisced about a visit to a Minnesota nuclear plant, maybe Prairie Island, where he could run around the waste repository in a few seconds. That prompted Colleen Wright, Vice President of Strategy and Growth with Constellation, owner/operator of the nation’s largest fleet of nuclear power plants, to mention that all the radioactive waste generated from nuclear power plants in the U.S. since the beginning in Shippingport, PA, 1957, could fit waste generated since nuclear power began operations inside a Walmart Supercenter.

Urika! I immediately thought of a perfect solution. La Crosse has a lovely, abandoned Kmart eyesore that closed decades ago. There you are! Supply meets demand.

Figure 2 Nuclear Waste Storage Facility for Sale (One Security Camera Included)

An Eighty-Year Asset

An Eighty-Year Asset

Ms. Wright mentioned at least twice that nuclear power plants are 80-year assets. Think about that!

- What is the discounted cash flow on 80 years of future revenue?

- How does that compare with the 15-year life of a solar panel? (more below)

- Eighty years:

- ~Average life expectancy of a human

- Two careers

- Cyclical, generational theory and fourth turnings, like WWII

- Hyperscalers want power purchase agreements of only 15 years

Germany unconditionally surrendered to the Allies eighty years ago, before the jet engine was invented. For a glimpse at how the technological world has changed since then, I suggest one of my favorite movies, Saving Private Ryan – manual typewriters, blimps, and savage warfare.

The DOE claims the estimated lifespan of a “PV module is about 30-35 years,” while Utility Dive reported in 2023 that solar farms are approaching a midlife crisis. Inverters are failing at the 10–15-year mark. Set it, but don’t forget it.

One of the panelists suggested renewables are like bicycles (where have I seen that before?). Coal and gas-fired thermal generation are like automobiles and nuclear power, like tanks—rugged or durable. I don’t know the durability of tanks, but tractors can easily last 70-plus years with decent maintenance. Figure 3 features my starter tractor on the left, a ~ 50 hp gasser on the right, and the modern 450 (hp) diesel edition on the right. As for nuclear power plants, I believe a 1,000 MW plant will always be large.

Figure 3 1957 IH Farmall 450 vs. 2020 IH 450 – A Few Decades of Tech Advancement.

I have another analogy. If power generation were art, solar would be your kid’s crayon masterpiece, and nuclear would be Mount Rushmore.

I have another analogy. If power generation were art, solar would be your kid’s crayon masterpiece, and nuclear would be Mount Rushmore.

Cash Flow Analysis

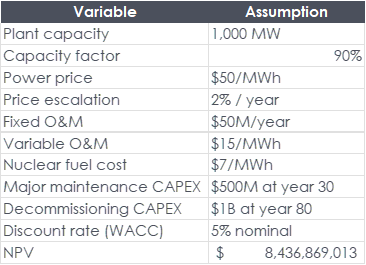

The discounted cash flow on an 80-year asset is a serious question. I directed ChatGPT to generate a net present value (NPV) of discounted cash flows for a nuclear power plant, leaving out some details because I can’t give away everything. Like a smart 22-year-old college grad, it puked out the results summarized in Table 1.

Table 1 Nuclear Power Plant Net Present Value Inputs and Results

I critiqued the analysis and noted the following:

I critiqued the analysis and noted the following:

- Constant O&M cost, no escalation

- Fuel cost is high

- New nuke runs $10,000 per kW(MARC panel), or about $10 billion for a 1 GW plant analyzed.

These results are in the ballpark. Tweaks around the edges matter, big league, in an 80-year analysis period.

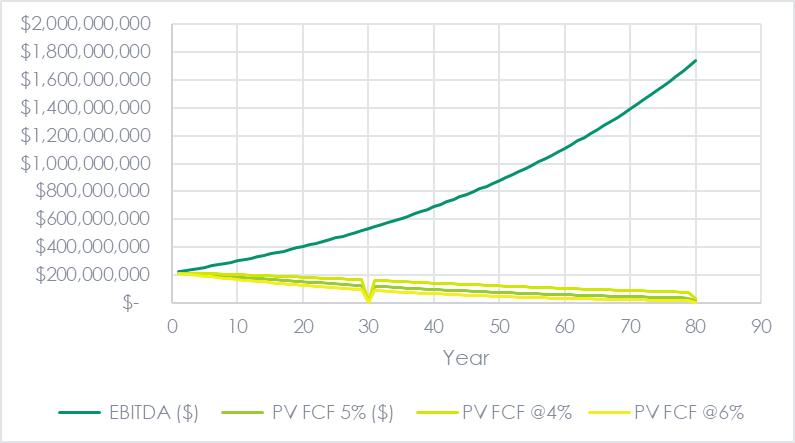

Figure 4 demonstrates the primary challenge with nuclear power. Although future cash flow soars, the present value of the future dollars is gnawed away by the discount rate, which represents the opportunity cost of capital. The dip at year 30 is for an assumed major plant overhaul, e.g., steam generator replacement.

- EBITDA = earnings before interest, taxes, depreciation, and amortization

- FCF = free (or future) cash flow = EBITDA minus maintenance capital expenditures in years 30 (overhaul) and 80 (decommissioning)

- PV = present value

Figure 4 80-Year Cash Flows of a Nuclear Power Plant

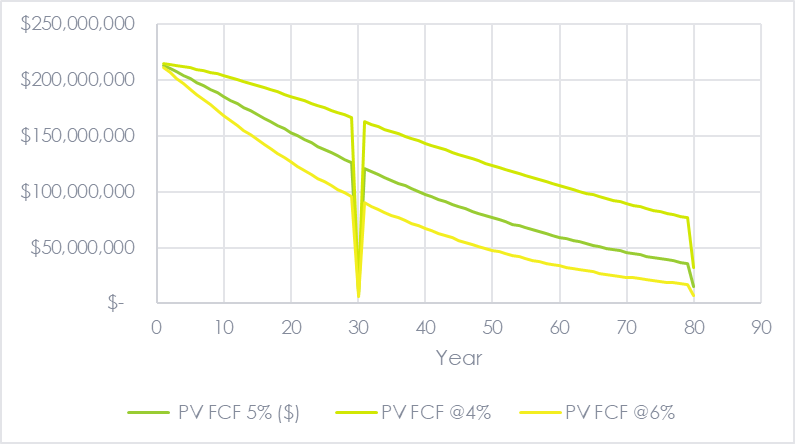

Since the present value of future cash flows is so compressed, I removed the EBITDA data and replotted it in Figure 5. Year 80 includes an estimated decommissioning cost. A couple of ticks difference in the discount rate changes the value of future profit by 3:1 from 4% to 6% real discount rate. Tiny perturbations become huge over 80 years.

Since the present value of future cash flows is so compressed, I removed the EBITDA data and replotted it in Figure 5. Year 80 includes an estimated decommissioning cost. A couple of ticks difference in the discount rate changes the value of future profit by 3:1 from 4% to 6% real discount rate. Tiny perturbations become huge over 80 years.

Figure 5 Present Value of Nuclear Power Plant Future Cash Flows

As for SMRs being more cost-effective, Ms. Wright noted that once a design stacks three or more SMRs, you might as well build an AP1000, Westinghouse’s 1.1 GWe design, which includes natural circulation cooling, as I noted above. ????

As for SMRs being more cost-effective, Ms. Wright noted that once a design stacks three or more SMRs, you might as well build an AP1000, Westinghouse’s 1.1 GWe design, which includes natural circulation cooling, as I noted above. ????

Public Private Partnership?

Assets with useful lifetimes over 30 years (mortgages, treasuries) include land and infrastructure like roads, bridges, ports, and tunnels. They also include, hmm, what could it be? Dams! That’s precisely what I was thinking. A nuclear power plant has more in common with the Hoover or Robert Moses Dams than a gas peaker or combined cycle natural gas power plant. Those dams have 90 and 64 years of power generation history.

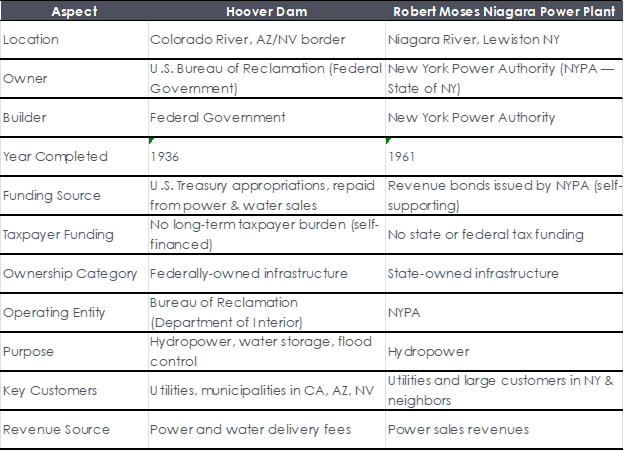

Should these 80-year assets be funded by a public-private partnership, or PPP? How were these dams financed? One hundred percent from revenues generated by the assets over many decades, per Table 2. The federal government financed the Hoover Dam while the State of New York financed the Robert Moses Dam. The trail was blazed. Could/should we do it again?

Table 2 Hoover and Moses Dam Asset Comparison

An Eighty-Year Asset

An Eighty-Year Asset