Energy is a commodity, and like all commodities, it is wise to hedge risk; not go the other way and place bets. Unless you are a certain presidential candidate with privileged information on cattle futures, I would stay away from betting, er investing in, commodities in general, and energy specifically.

To digress for a moment, recall when gasoline cost $4 per gallon, there were all kinds of calls to investigate price gouging and rigging the market. Bill O’Reilly would ignorantly rant about the “speculators”. I said then, in 2008 just before this blog was born, that was poppycock. Senators Chucky Schumer and, uh oh, Bernie Sanders, also rallied against oil companies for gouging. That would be dangerous, and I’ll get to that below.

Speculators include those managing risk – for airlines, railroads, trucking companies, farmers, and more. They buy futures to hedge against additional price increases. They take money off the table when they think prices have gotten ahead of the market. They provide a vital function to the market: liquidity. They help calm the seas reducing peaks and troughs. For every winner there is a loser. Note to all grandstanders: you don’t know what you are talking about.

Deregulation? Are you Sure?

Ohio presents a classic case of betting on energy futures[1]. Just before the Enron implosion, there was a stampede to deregulation. Deregulation essentially splits transmission and distribution away from generation. The T&D remains a regulated monopoly. The generation assets transition to a deregulated market. In this transition, utilities may keep the generation assets or sell them (would have been a wise move, believe me).

Making Money

This article from R Street, a non-partisan, non-profit think tank provides some sequence of events that have Ohio yo-yoing on energy policy. Back at the turn of the century, Ohio flipped to deregulation. Are you utilities sure you want to do this? Yes; we will make more profit from our coal and nuclear plants in an expanded market.

And so they did. They made a lot of money on these generating assets, at first. Along the line around the end of the first decade of this century, because of rising energy prices, Ohio joined many states, particularly in the Midwest, including Illinois, Indiana and Michigan, and plunged into energy efficiency.

Goes Around, Comes Around

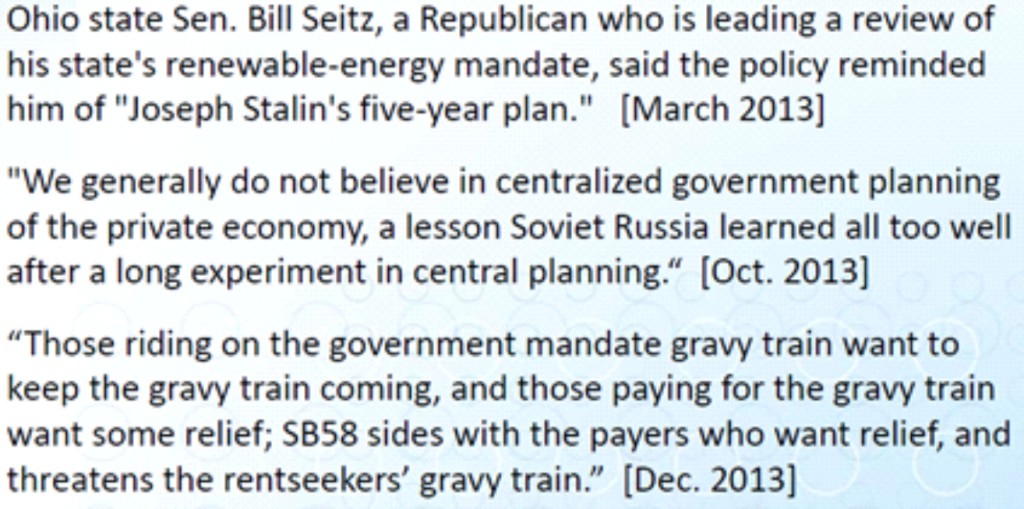

A few years ago energy prices, in particular natural gas prices, imploded. Uh-oh. Now the golden geese are albatrosses. Once cheap natural gas set in, FirstEnergy and Ohio Senator Bill Seitz sought to kill energy efficiency because it raised prices for consumers. To refresh your memory, I wrote about this via Marty Kushler (ACEEE) via MEEA’s annual meeting of its membership a couple years ago. Here are some quotes from Marty:

Pause for chuckle here.

Click forward to this year. Per the R Street article above, FirstEnergy and AEP lobbied to put price floors on electricity so they can end the hemorrhaging of cash from their former golden geese. The price tag for consumers would be an extra $2 billion.

Did somebody say something about mandates, government planning, and higher prices?

PUCO Obliges, FERC: Nope

The Public Utilities Commission of Ohio (PUCO) approved the price floors as requested by FirstEnergy and AEP. Later, FirstEnergy found religion of energy efficiency once again and began to “offer” efficiency programs to help customers reduce electric use.

What is it? Does efficiency increase costs or decrease costs for customers? Is government planning good or bad?

I should note that AEP conversely didn’t flinch or waver at all, to my knowledge, in its commitment to energy efficiency in Ohio. That demonstrates political discipline.

PUCO’s ruling stood for almost a month before it was shot down by the Federal Energy Regulatory Commission, whose main charter is to regulate wholesale power, which is what this is, particularly in interstate commerce.

Deregulation is Risky

Companies who want deregulation of anything have to be prepared for eventual pain – just ask the major airlines and a bunch of telecom companies, many of which no longer exist. There will be pluses and minuses for producers and customers alike. For example, the industry is flooding into natural gas and renewables now because it’s cheap. The market is de-diversifying, and at some point, probably within a decade, that is not going to end well for consumers. Deregulated markets don’t care what fuel costs are. In regulated markets, these are pass-through costs leading to some short term volatility, but it is choppy seas compared to a tsunami.

Intervention is Myopic

Intervening in a deregulated market is a bad idea because it creates major uncertainty for potential suppliers, decreasing supply and necessarily, higher prices. In the Ohio case, it would result in high prices now due to the price floor, and higher prices later because of the added risk.

Ohio is not alone. Maryland also wanted to provide price floors for new natural gas generation out of concern for future shortages. The Supremes were involved with this case and smacked it down 8-0. Like pregnancy, you’re deregulated, or not.

Efficiency is Mitigatory

Again, to sell efficiency in plain language, it is the great risk mitigator. If prices rise, customers save more. If prices fall, customers have even more money in their pockets.

[1] Not literally futures trading instruments but future energy supplies.