Criminal Pricing

When I walk into any office supply store, my jaw always drops in the printer section. A common inkjet cartridge costs $20 and weighs roughly 2 ounces. Let’s assume all 2 ounces are the liquid ink (I’m feeling generous). Knowing there are 128 fluid ounces per gallon, the rough cost for ink is about $1,200 per gallon. And you thought gas was expensive? How do they get away with that?

Because they suckered you in with a cheap printer, that’s how. I would wager that most printer manufacturers barely make a nickel when they sell you a printer. It makes sense, because once you have that printer on your desk and connected to your computer, you are stuck buying their cartridges, which means they can charge practically whatever they want! The trouble is this sort of outrageous pricing is more common than you might think, so it is important to realize when it’s happening.

Avoiding the Trap in Buildings

In the same way, some HVAC controls companies nearly give away their systems for the price of a service contract. Who can turn down controls that cost a fraction of their competitors? Buyer beware! Once they’ve installed their equipment, suddenly that technician coming on site has a bill rate that you would expect from a corporate lawyer with an office overlooking Manhattan. But that’s tough luck for you, because now they control “your” system.

The same thing happens with inexpensive HVAC equipment. The first cost can be significantly less than the efficient stuff. But as the years roll by, and each utility bill makes you cringe more and more as energy costs go up, you’re paying the true cost of the “inexpensive” choice.

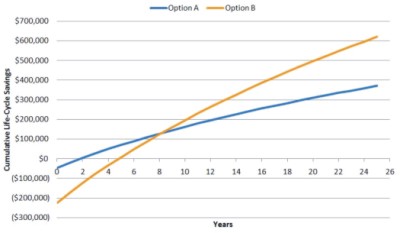

It’s also important to note that even if an option has a short payback it doesn’t mean it’s the right option. Let’s consider two efficiency options. Option A is cheaper and pays back in 2 years. Option B is more expensive and pays back in just shy of 5 years. Obviously, option A is the better choice, right?

Wrong! Check out the chart. In this example, any company in business more than 8 years will be better off with option B! If you’re going with option A, you better be ready to explain why you’re not looking out for the long term interests of the company, taxpayers, or donors!

Will someone please think of the children?

Do you expect to print more than a few hundred pages? Run away from inkjet as fast as you can. Does your maintenance staff know how to use a mouse and keyboard? Get a controls system that your staff can manage easily. Do your accountants know what a net present value is? Get an engineer to tell you the real (i.e. life cycle) cost of the equipment you’re going to buy!

You need to know how much something is going to cost long term, even if your analysis period is only 10 years rather than the more common 25-30. If you don’t, someone’s going to make a pretty penny on your back.