One sign of a good teacher is how many things stick with a student through life. As I thought through the Bitcoin maze, I thought of the following gems I collected from my personal finance instructor:

- Anything is worth what someone else is willing to pay for it (I add my own to this – everything is for sale if the price is right).

- You will never grow broke taking a profit.

- If the price isn’t zero, it can always go lower.

- The most likely price in the future is the current price.

Those statements apply mostly to securities, and they REALLY apply to Bitcoin. Last week I listed a bunch of ways Bitcoin was like gold . However, it is unlike gold and more like the virtual currency, the dollar, in that there is absolutely no intrinsic value to it whatsoever. It is purely worth what the next guy will pay or trade for it.

A Lousy Currency

Due to its volatility, Bitcoin makes for poor currency at this point. Does a buyer want to spend two Bitcoins[1] on a new car, when at the end of the year they could have spent one Bitcoin for the same car? That is deflation. On the other side of the (pun alert) ledger, does the seller want to take two Bitcoins and then see Bitcoin value tank 75%? That is hyperinflation. Until Bitcoin achieves exchange rate stability, it will not be widely used to buy and sell products and services.

Why was Bitcoin started? One reason was to build a more secure, less expensive way to handle transactions. Last week’s post explained how transaction processing is funded with freshly mined Bitcoins. Transaction fees are also charged when they are secured into a block and blockchain. Transaction costs have been highly volatile and paid in dollars. In my mind, this begs the question, why are transaction fees measured in dollars? Answer: because Bitcoin is a hedge and a roulette wheel; not a currency, yet.

Dirty Mining Power

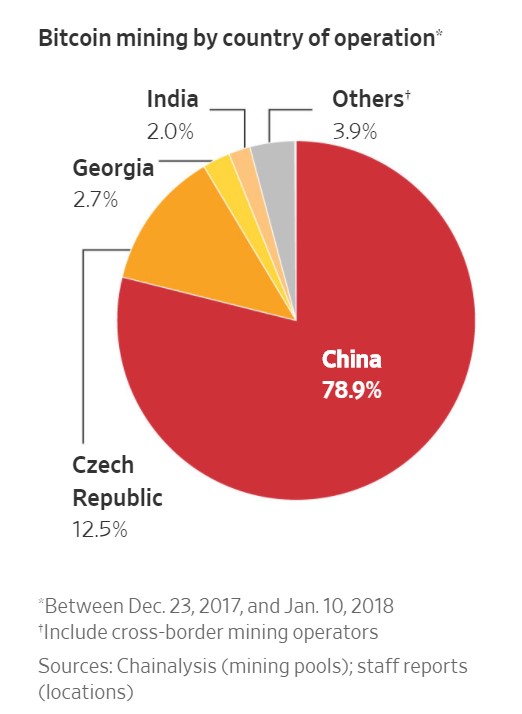

Let’s go to the energy side of the story. I just learned last week in this Wall Street Journal article that China has ordered the shutdown of its Bitcoin mining operations. Uh oh. That would appear to cause major liquidity problems as they handle almost 80% of Bitcoin transactions. Three things worth noting on this:

- China’s centralized communist governance would abhor a decentralized libertarian currency like Bitcoin. Does Chinese currency manipulation sound familiar?

- China holds a huge advantage in mining competitiveness due to its abundant “dirty” coal-fired electricity.

- Blockchain is an enormous threat to counterfeiters and stealers of intellectual property. Imagine!

Per the PRI article, a simpleton from Grist claims that by next summer, the Bitcoin network will require more electricity than all of the United States. Seven months after that, it would require more electricity than the entire world.

That isn’t going to happen. As alluded to above, Bitcoin is one of the truest distributed, free-market platforms in existence. Miners require massive computing power and energy supply. They will pass costs to customers like any other business.

Transaction costs will also be set by supply and demand. When 80% of the miners go out of existence, you can bet transaction costs will increase, drawing other miners. Bitcoin value will drop as these miners shut down because it will become less liquid and harder to access. Fewer buyers means lower prices.

Blockchain’s Value Proposition for Energy

About ten years ago, during the LEED® heyday, buying carbon offsets was the rage, except no one could see it so buyers would have to advertise their do-gooderism on their websites.

Yeah, and I have a second cousin’s fortune that I’ll share with you if you wire $1,000,000 to my bank account, and we will split the fortune. What’s it for? I don’t know. Just wire the money in the next 15 minutes or this opportunity will be gone forever.

How authentic was that nothingness you just bought? Here is one huge opportunity for blockchain – it will track the production or sale of any one thing until it is delivered to a customer.

Blockchain can be used for tracking renewable energy. Do-gooder giants like Facebook, Google, and Microsoft claim to be powered 100% by renewable energy. That is guaranteed not possible. The grid supplies a puree of electricity. It is not a fruit salad. I.e., if strawberries represent renewable energy, it’s all pureed in the blender and Facebook cannot claim to only eat the strawberries from the puree. Blockchain can be used to track strawberries in “packets”, and therefore, charge the benevolent Facebook accordingly for it’s true cost of 100% renewable energy. But that isn’t even possible without massive electricity storage, so knock it off.

Blockchain can be used to match buyers and sellers on a small scale in real time, so there is no more fake (net metered) 100% renewable-energy consumers. Consumers and prosumers can demonstrate that every electron they consume came from renewable generation, which may include batteries, don’t forget.

Next

At the moment, cryptocurrency bubbles are taking up all the blockchain jabber. Beneath it all is a methodology that may transform many industries and peer to peer transactions throughout the world – including and especially, energy.

[1] Bitcoins are divisible down to something worth far less than a penny at the current exchange rate.