The Energy Rant blog, in general, could be considered the sausage factory of energy efficiency; exploring the inner workings and realities of the business. Everyone else writing about energy efficiency is talking about the delicious bratwurst and hotdogs one might get at the ballpark. This week, however, we will explore EE from the utility shareholder perspective, in the sausage room, rather than the ballpark frank of conventional wisdom.

To further define the sausage room of energy efficiency, this time I begin with a white paper by ACEEE,Policies Matter: Creating a Foundation for an Energy-Efficient Utility of the Future. One gist of the paper is to describe the benefits of energy efficiency. Those are:

- Lower cost – the cost of avoiding energy use is cheaper than generating and delivering it

- Lower risk – less susceptibility to source energy costs, lower maintenance, and less risk from regulatory uncertainty

- Reduced emissions

- Economic development – replaces resource depletion with innovation and manufacturing (my description)

- Economic growth – lowers cost of doing business for customers

- System resiliency – reduces peak demand

Although the paper goes on to discuss how policy can be molded to benefit utilities, none of these primary benefits directly apply to the utility.

Utilities make their money by building stuff to deliver energy (rate base). The cost of source energy, aka fuel, is a pass through cost. Bullets 3-5 don’t benefit the utility. The last one, resiliency, again mainly applies to customers. When resiliency is depleted, utilities get to build more stuff and earn more money.

It is important to note that once a major investment like a power plant is approved, it is funded by more debt (e.g., bonds), equity (stocks), or cash on hand. I’m not going to review gobs of utility balance sheets, but if utilities carry typical debt to equity of about 50% (substantial debt), why would they have a big pile of cash sitting around? They wouldn’t. So they borrow more or sell more equity. Neither benefits current shareholders. More on this below.

So, let’s look at this from the utility perspective. If I were a utility executive, my bosses, other than the board, are shareholders – the owners of the company. Shareholders rule. Going back some 25 years to my personal finance class, the reason people invest in monopolistic utilities is the dividend.

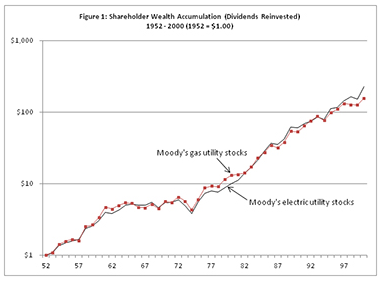

But even so, sales don’t matter to the long-term return for investors. I described this in multiple posts including Utilities: A Formula for Contraction. Although, I must say, a recent AESP Strategies article by Steve Kihm and Tracy La Haise from Seventh Wave provided superb crystal clarification of this fact. The article features the following two plots.

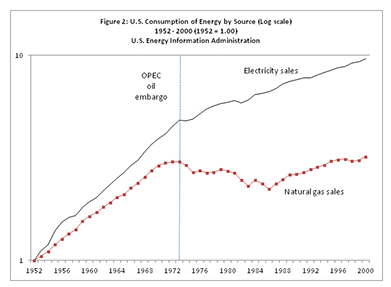

The first plot shows sales of natural gas and electricity over fifty years. Sales of electricity have risen consistently, with blips during recessions, but natural gas consumption has been flat for thirty years. The plots are normalized to 1952. By this, one might prematurely conclude natural gas utilities would have been a terrible investment.

Not so. The second chart shows investor returns, and they are virtually the same for natural gas and electricity – because investment on rate base for each has grown at about the same pace.

So, I am an investor looking for something relatively safe, but I want to earn some money. U.S. treasuries, money market funds, bank certificates of deposit are all crap. I might as well leave my money in a checking account earning nothing. At least it is FDIC insured. Of course, if there is a run on banks a la Greece, that insurance is worthless because the dollars insured become worthless, but that is another story.

I only know utility-rate-making from far away, but I do know that return on rate base is smeared out over decades. Therefore, the dividend is stable over the long term.

Dividend and yield are two different things. Dividends are in dollar increments and yield is dividend divided by stock price. As an investor, I’m interested in the yield because that is what I compare against alternatives; bonds and so forth.

When interest rates drop, bond prices go up and their yield goes down. Suddenly, the utilities with 3-4% yields look spectacular compared to 1% on treasuries and zero on money market funds. Investors should pile into utility stocks, driving their price up and bringing their yields more in line with bonds.

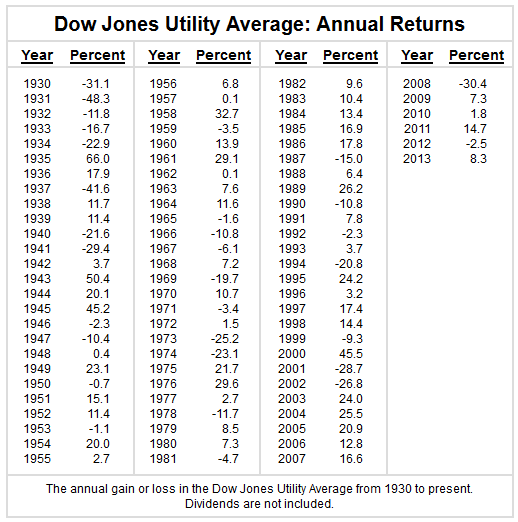

However, nothing personifies lemmings more than investors of all stripes. Consider the historic annual return on utilities shown in the chart below. Every recession produces a substantial downturn in utility stocks; sometimes drastic downturns. The deep recession of 1973-1974 indicates stocks lost half their value.

Apparently, utility investors follow their lemming brethren and sell at the worst possible time. My non-advice is buy utilities during recessions. They are going to get their money out of their assets. They have a captive customer base that isn’t going anywhere.

So, the bottom line to utility investors who rule: energy efficiency isn’t going to damage your investment whatsoever, provided of course you have direct cost recovery for the programs. In fact, bullets four and five above will return “dividends” to help stabilize your investment. Unless you are smart and buy at the depths of recessions, utilities are not stock-price-growth investments. You get exponential growth with utility stocks by plowing dividends back into additional stock purchases.

As with most things in life, investors have far more control over their investment, than somebody else’s activities, in this case energy efficiency. Investors can run over the cliff with the lemmings when there is a downturn, or sit tight and even buy more.