Thank you American Council for an Energy Efficient Economy for clearing the decks to talk about tax policy and energy efficiency – enabling me with its Three Tax Reforms to Encourage Modernization of the Manufacturing Sector.

Allow me to divulge some truths about our confiscation, er I mean, federal tax policies. In five words: small business gets the shaft. Small businesses earn their profits in the US and they are pass-through entities, the profits from which are taxed at the owners’ personal tax rates far above typical effective corporate tax rates. The IRS extracts a pound of flesh for every three pounds produced. Corporations; not so much. (see the chart nearby). I can tell you why/how but that’s a story for beer time somewhere.

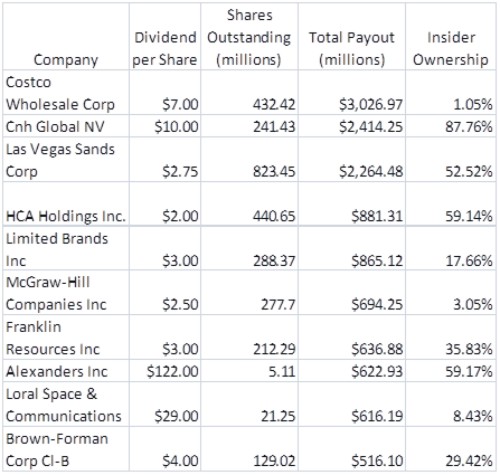

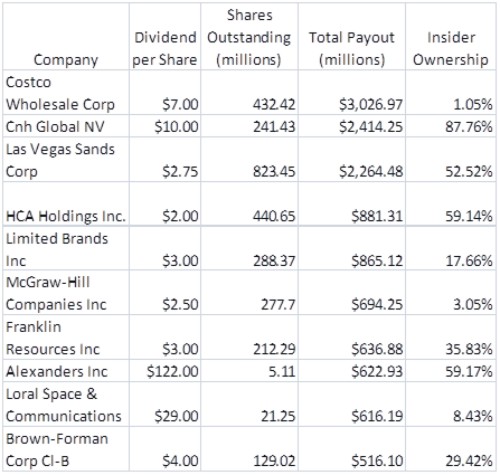

A case study in monetary and tax policy perversion of capital: Interest rates are nearly zero as the Ben Bernanke prints money to finance the deficit and debt[1]. Taxes (the “cliff”) are set to rise in a few days so what are corporations doing? Dumping cash to shareholders. Costco for one is borrowing $3.5 billion to pay a one time $3 billion special dividend to shareholders. The debt will be repaid by future earnings. And former CEO, Jim Sinegal wants the rest of us and in particular small business to pay higher taxes. Hypocrite.

In fact, as of last week reported special one-time corporate dividends totaled roughly $23 billion and note, Apple with $90 billion in cash is not included in this list.

Conclusion: taxes matter.

The first proposal by ACEEE is to lower the tax on repatriated money. ACEEE claims the cost to the treasury would be low. I disagree. The cost to the treasury will be negative. In other words, the treasury will increase its haul because the current 35% of $0 is $0. Ten percent of hundreds of billions of dollars is billions and billions of dollars – not even counting the ensuing corporate, income, property and all kinds of taxes business expansion in the US will deliver. I have no doubt the majority of lawmakers in Washington are clueless about these things. A confiscatory tax rate that can / will be / is avoided produces no revenue to the treasury. The result is a pre-cliff surge in tax revenue in 2012 on LOW taxes followed by a dearth next year. I’ll provide the data when it becomes available.

- Bottom line: I strongly agree with ACEEE that repatriated dollars should be taxed at a far lower rate, if taxed at all.

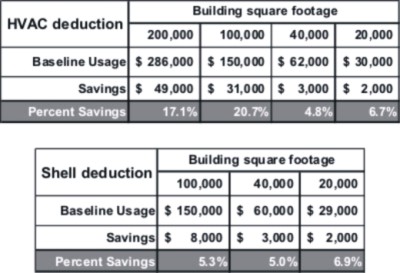

The second proposal is to use accelerated depreciation to get a near term tax benefit from energy efficiency projects. ACEEE claims this will not cost the treasury anything because it simply shifts the tax burden to out years. I too like this policy but I would want it across the board. Defining an energy efficiency project would be a mess. Trust me. We have seen many absurd claims in self-directed (customer directed) / opt-out (of EE programs) projects. Companies, let alone the IRS, do not know what energy efficiency is. For example, spending money to consolidate manufacturing to one facility, or from two shifts seven days a week to three shifts five days a week is NOT energy efficiency. But customers think it is.

- Bottom line: I agree with ACEEE but let’s use accelerated depreciation across the board for all types of investment.

The third proposal is a tax credit of 35% of the investment in EE to be repaid over 10 years. I understand the benefit but linking it to reality is a bit more complicated than the first two. If the project lowered energy consumption by the cost of implementation over 10 years (e.g., 10 year payback), this gives the customer a tax incentive in year one to be repaid over the 10 years. So it seems like financing the tax payments.

- Bottom line: This wouldn’t be attractive to me and like the second one, it is too burdensome and easily gamed.

Number four is Jeff Ihnen’s idea: lower the corporate tax rate across the board and nix all the perverting tax loopholes and credits. Let’s move from the highest corporate tax rate in the world to one of the lowest, say 10%. Eliminate the tax on repatriated capital. The treasury is getting nothing from it now and allowing those dollars to flow back will allow companies to expand here in the US, creating corporate income tax, jobs and associated personal income tax. A summary of enormous benefits:

- Jobs – Washington’s clueless fixation.

- Higher tax revenue.

- MORE energy efficiency[2].

- Insourcing jobs.

- Capital will flood into the most productive country in the world – ours.

- Greenhouse gas reduction – think of that! China is building coal plants willy nilly. The US is shutting them down ON TOP of being more energy efficient and more productive.

Everyone except perhaps our foreign competitors and Washington wins here. However, there remains one mammoth obstacle: ignorance and/or lust for power in Washington. Lowering and flattening the tax code while getting rid of deductions and credits takes away power, manipulation, and ability to divide the electorate to win or buy the next election.

[2] Energy efficiency builds the bottom line and taking less in taxes makes it more attractive.

“I support cutting taxes under any circumstances and for any reason, whenever it’s possible.” – Milton Friedman