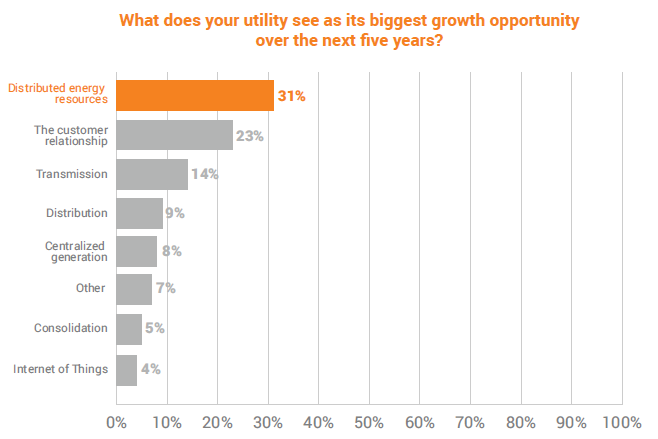

Recently, Utility Dive released its report, 2015 State of the Electric Utility – a compendium of utility company prognosticative surveys. Findings include:

- Utilities will move away from vertical integration – see last week’s Utility 2.0.

- The biggest opportunities are distributed generation, transmission, and customer relationships.

- The biggest challenges include old infrastructure, old employees, and primitive regulatory models.

- The biggest concern is flat to declining sales.

- There will be more use of natural gas, wind, solar, and distributed generation. As my personal finance instructor used to say, the most likely price (trend) tomorrow is the price.

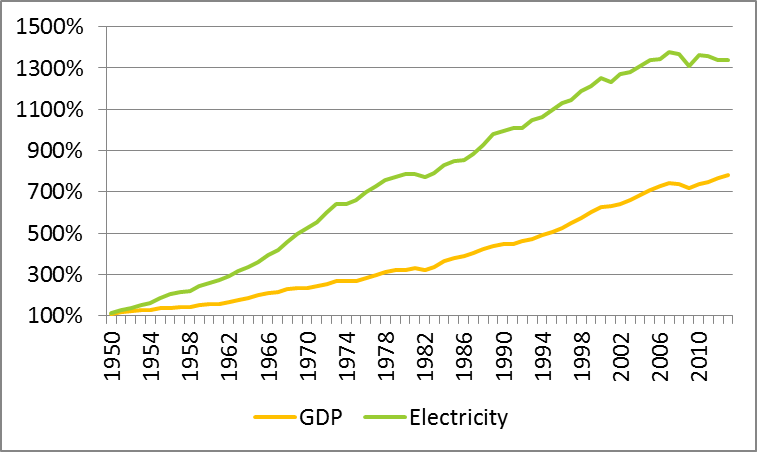

First, I wanted to see if consumption is falling for real, or because the economy has been crumby for going on eight years. I looked at this last summer using data from 1990 through 2014. The moral of that story was that we have clearly fallen off our exponential growth trajectory dating back to The Great Depression. Symptoms of that included lack of new construction in the past 4-6 years. In a world where commercial and residential buildings consume about three quarters of electricity, a genius degree is not required to conclude this is stunting demand for electricity.

This time I dug up electricity generation records going back to 1950 – a difficult find. I wanted to see how electricity consumption growth varies with economic growth. Is there a linear relationship? Is there an offset – meaning is electrical demand growth zero at 2% GDP growth? Or 1%? Or 0.5%?

This first chart simply shows normalized GDP (adjusted for inflation) and electricity consumption. It is interesting to point out that the two major recessions in this period appear to have changed the relationship between GDP and electric consumption for the long term. The first is the early 1980s recession. Prior to this, electricity consumption was growing faster than GDP.

For the next quarter century, electric consumption grew more in lock step with the economy. The next inflection point appears to have taken hold in the most recent 2007-2008 recession. In recent years, it appears the economy has taken on a linear growth pattern, and electricity use has gone flat.

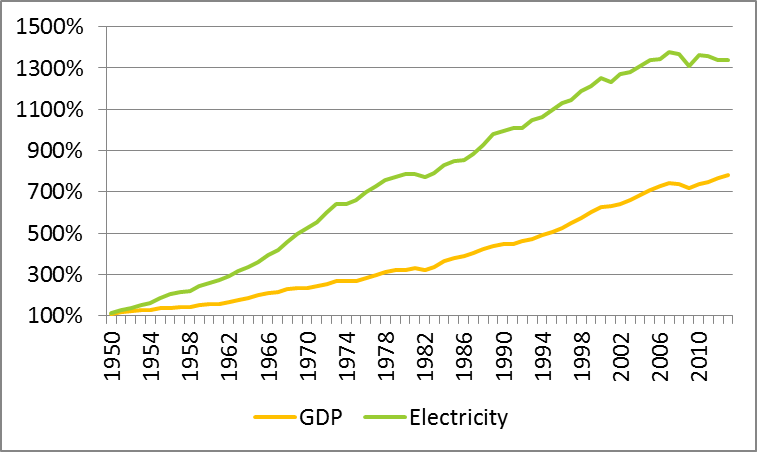

Observe the electricity sales growth against the economy for these three periods (see charts 2, 3, and 4 above). First, I plot this relationship from 1950-1980, then 1981-2002, and finally, 2003-2012.

In case you are not a data geek, the plots show the following, with my opinion on what occurred during these periods:

- The 1950-1980 period (or mostly through 1970) was boom time in the US. No one was concerned about the environment until rivers caught fire and cow manure floated as green blobs in the lakes around my hometown. In addition, air conditioning and wealth grew like crazy. I remember our first window shaker in the 1970s, followed by central air conditioning a few years later. As a result, electric sales grew faster than the economy.

- The next 20 years show a slowdown and maturation of the economy. Electricity consumption grew in proportion over the long term and at the same rate. This was a happy medium.

- The boom times are over as demonstrated by the last interval. Almost half the years from 1980-2000 saw growth of 4% or higher. Since then, none have. Here is something no one else will say: we’ve gone from wild growth with little regulation to running up a mudslide as a result of entitlements and regulation. The axes all have the same upper and lower limits. Look at how all the GDP dots, from top to bottom, have slid to the left – a lot! Although I didn’t need it, here is a comical video showing the code of federal regulations have ballooned 18-fold since 1950, which was smack in the middle of the baby boom. And the FCC just took over the internet so that will add a few more volumes to the pile.

Moving on.

Utilities see customer relationship as their second best opportunity behind distributed energy resources. The engagement/services includes energy efficiency (later determined the second best emerging technology). If this is what utilities are after, then I suggest a vastly different approach to energy efficiency than what has swept the fruited plain in recent years.

Customer relationships, engagement, and services include enhancing peoples’ lives and helping business thrive. This is at odds with the trend in energy efficiency programs in many jurisdictions. That trend is – give me impacts at the lowest possible price. What is the lowest possible price? Not something that helps customers but rather the easy stuff. I call it the raccoon approach to harvesting sweet corn. How do raccoons harvest sweet corn? About two days before optimal harvest time, raccoons like to come through and pillage the crop – the cream skimmers destroying the crop for a few bites.

Energy efficiency’s raccoons blaze through a utility territory pounding out lighting projects for the cheapest possible price because this is what utilities have asked for. Well, Mr. and Ms. Utility, if you want to help your customers, light bulbs are not the answer.

What will help your customers? Recognizing problems with productivity, maintenance, and bottlenecks, and then deriving potential solutions that fit the customer’s desires and needs. Great customer service and relationship building also includes a dose of energy management planning; in general, making customers more successful. This depth of engagement is occurring in few jurisdictions to date.

What have you, Mr. and Ms. Utility done for your large C&I customers? If all you have to offer are light bulbs and an “awareness” campaign, they have no need for your program.