Energy efficiency gets a bad rap, but I shall attempt to slap some sense into efficiency deadbeats. I will start by beating the simple-payback-is-bad dead horse one more time. It may giddyup and run as a result.

I am quite certain that one of the things that make investment in energy efficiency the homely mutt of corporate decision making is lack of trust in the savings. This is why it has always been bogged down with simple payback. Like, whew, when do I get my money back and break even on this lower-than-penny-stock gamble? I just want my money out. That’s all I care about. This is a stupid way to think.

If you have been in the industry more than a year or two, you have likely heard the argument that energy efficiency should be sold in terms of return on investment, such as savings to investment ratio, or life cycle savings, or net cash flow.

The savings to investment ratio is the total project savings, including quantifiable non-energy savings, over the course of the life of the investment, divided by the total cost, which includes first cost and maintenance. The life cycle savings, or net cash flow, is the savings minus costs for the life of the project.

The S&P 500, according to MarketWatch over the past five years, has a savings to investment ratio of 1.907. Note however, that this is simply the index value now divided by the index value five years ago. It does not include the opportunity cost of money[1]; i.e., what energy efficiency is always saddled with, nor does it include time-cost of money; i.e., inflation.

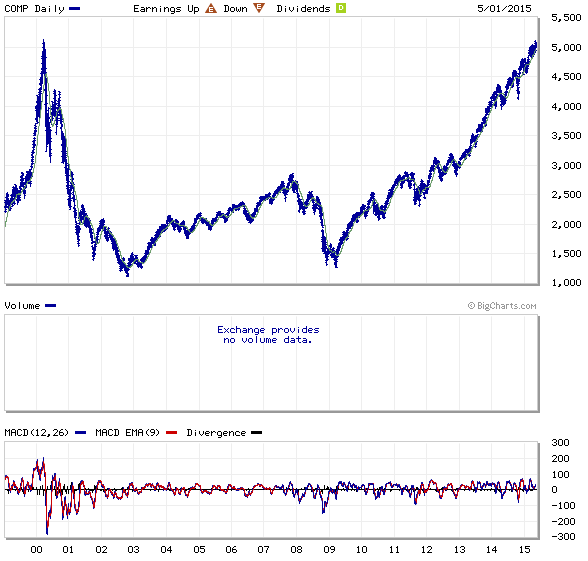

For instance, a few weeks ago, The Wall Street Journal, as I am sure dozens of other publications did, pronounced that after 15 years, the NASDAQ index had finally bested its early 2000 peak. One reader wisely commented, not so fast. It is not even close to a new high when adjusted for inflation. Indeed, the consumer price index, a measure of inflation, is 34% higher right now compared to the month of the previous peak in 2000. What is the simple payback on the NASDAQ index? Without a time machine, we don’t know. When will it return to its inflation-adjusted high? What if we piled on the opportunity cost of money, like we do with energy efficiency? It would look horrible.

Another stupid way to think is the way I viewed energy efficiency myself. That included what I considered the absence of exponential growth in wealth.

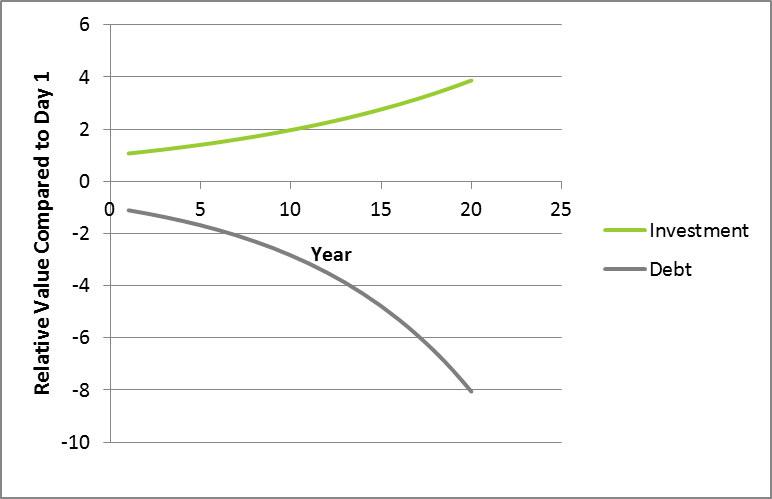

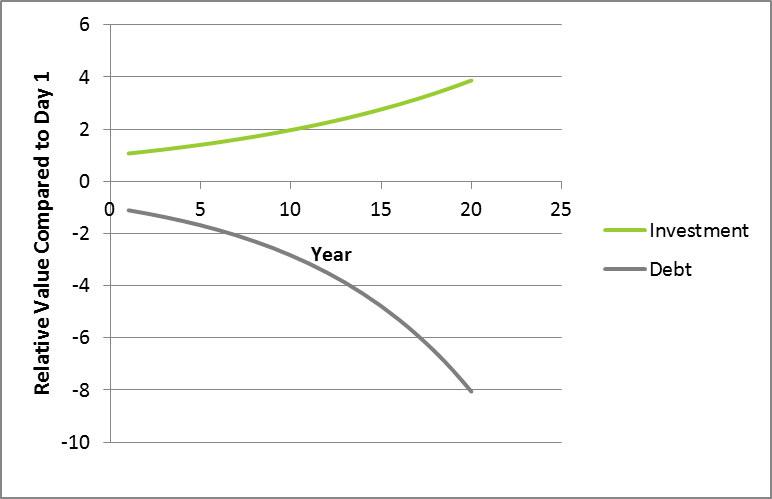

One thing parents should teach their kids about personal finance is the power of exponential growth. It works both ways. If you get behind on debt payments, it will swallow you whole. Debt and wealth grow in the same way, exponentially, unless of course you pay down debt or sell assets, respectively. Exponential growth simply means the trend gets faster and bigger with time, as shown in the chart for typical investment and debt balances with no withdrawals or payments, respectively.

The stupid part of what I was thinking for years is that energy users have a finite amount of energy to save and therefore, their return on investment is capped; sort of like a short sale where the gambler, er investor, borrows shares to sell now and buys them back later, hopefully at a lower price. The upside is capped at 100% – what it was sold for. The downside is the abyss. An energy efficiency investment has neither of these qualities.

The savings from efficiency projects and wealth creation pile up year after year, and as a business, it gets plowed back into growth like the blue line above. In the public / non-profit sector, it helps avoid the red line.

The other advantage energy efficiency has over other investments is assurance of savings, provided they are calculated with reasonable accuracy. Compare this to other corporate gambles that completely bombed/backfired and cost companies major public relations. One is Starbucks #RaceTogether where they asked baristas to strike up a conversation with customers about race. I’m not even going to waste time explaining why this was a horrible idea hatched by an unbelievably successful company. Another was McDonald’s “Pay with Love” campaign where customers get free food in exchange for a publically embarrassing stunt. These are like O&M[2] measures in that they cost little to implement, but the damage done was free of charge via bad press.

In another enormous gamble, PepsiCo will try to stem its Diet Pepsi slide by replacing aspartame with sucralose. What is that going to cost, and what is the ROI going to be? The term, catch a falling knife comes to mind.

Five years ago I compared and contrasted energy efficiency investment against stocks and bonds. Stock and bond prices go up and down. New products (“new” Coke), or product overhauls, can bomb. Energy prices, in particular electricity, rise – about 40% in the past decade, and prices are picking up more momentum as coal plants shut down. What’s not to like about hacking into a rising cost of something you can act on?

Lastly, efficiency is good PR. Business’ customers won’t turn red with embarrassment or run for the door, followed by Tweeted displeasure of waiting in line too long or listening to or watching strangers practicing group-therapy-like acts in public.

[1] If I wasn’t throwing money at EE, I could make 75% annual returns on something else, for example.

[2] Operations and maintenance; low cost / no cost EE measures