I have always found it interesting that “demand-side management,” the term that is generally used synonymously with energy efficiency programs, includes virtually no demand management whatsoever.

The term “demand-side” simply means the energy consuming side of the energy transaction, whereas, “demand” is an instantaneous power draw from a device, building, feeder line, substation, power plant, or an entire power grid.

To date, energy efficiency programs have primarily been in search of any kWh (energy) savings at any time. I call these kWh “dumb kWh”. So, we have dumb energy efficiency savings from a supposedly smart grid. Discuss.

This has got to change, and it may be starting, finally. This paper from the 2016 ACEEE Summer Study on Energy Efficiency describes the historical view of efficiency versus demand response[1] quite well:

While investments by regulated entities in energy efficiency have enjoyed broad growth thanks to top-down directives, demand response has—with some exception— remained largely within the sphere of private market third party curtailment service providers who aggregate commitments and bid them into wholesale power markets.

What is Demand Response?

I’ll take DSM for $500, Alex.

This “is a change in company electric usage from normal consumption patterns in response to changes in the price of electricity over time in response to incentive payments designed to induce lower electricity use at times of higher prices, or a change in electric usage by end-use customers at the direction of a system operator or an automated preprogrammed control system when system reliability is jeopardized. Includes both time-based rate programs and incentive-based programs.[2]“

What is demand response?

Could you be a little more specific?

What is a demand response program?

Ding. Ding.

Therefore, demand response is a change in customer electric usage patterns resulting from an economic stimulus to do so. It includes either paying high prices, which are reflective of what the utility is paying, avoiding those impacts by curtailing consumption during those periods, or (and possibly, also) being incentivized by the utility to curtail.

Demand Response Benefits

Many electric loads, especially electronics, require very precise voltage and frequency regulation, or they will be damaged or destroyed. A tiny fraction of the population understands the challenge of meeting these requirements at an instant’s notice, but also at slightly longer (seconds) and longer (minutes and hours) time scales.

Disturbance Protection

Demand response provides reliability to the grid in the minutes-to-hours timescale. In the shortest timescales of demand response, we have disturbance control. Disturbances include anything that requires the grid operator or balancing authority[3] to dip into its operating reserve, which is typically in the 10-15% range. That is, 10-15% extra capacity ready almost instantly, in spinning reserves – hot, synchronized, turbines, generally speaking – kind of like a warmed up car ready for a drag race.

If these reserves are needed, demand response may kick in. Balancing authorities will pay more per kW of demand response if it is available faster. Speed is everything. They’re keeping the lights on!

Capacity

Confession: I’ve never balanced loads, so I’m guessing at some of this.

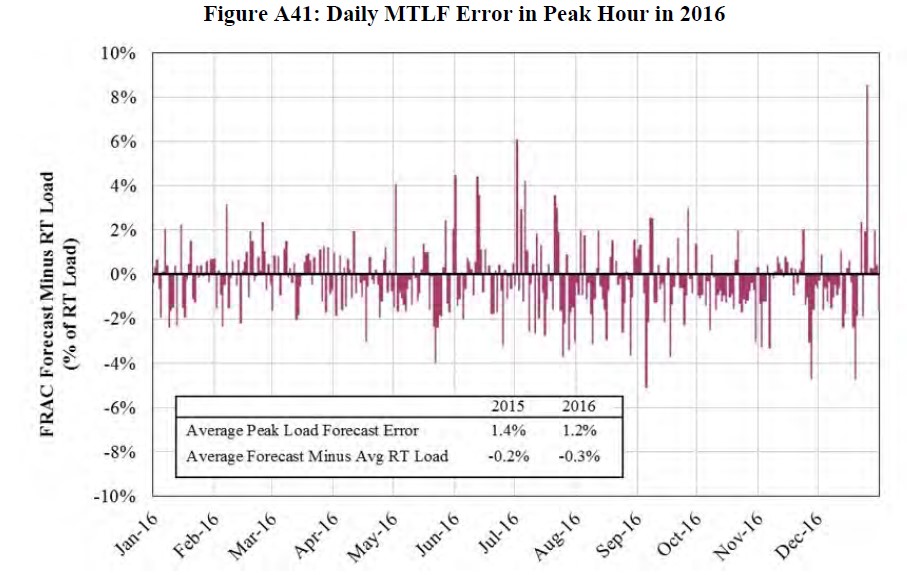

Having available reserves requires forecasting extra-long term[4] (20 years), long-term (this summer), and mid-term (day-ahead). The figure below shows the mid-term load forecast error for the peak load for the Midcontinent Independent System Operator, MISO.

When you have a big error in forecasting, it might trigger a capacity need for demand response. This is especially becoming the case with high penetrations of wind generation coming online. The load, particularly for air conditioning, is not affected whatsoever by wind. Instantaneous generating capacity is.

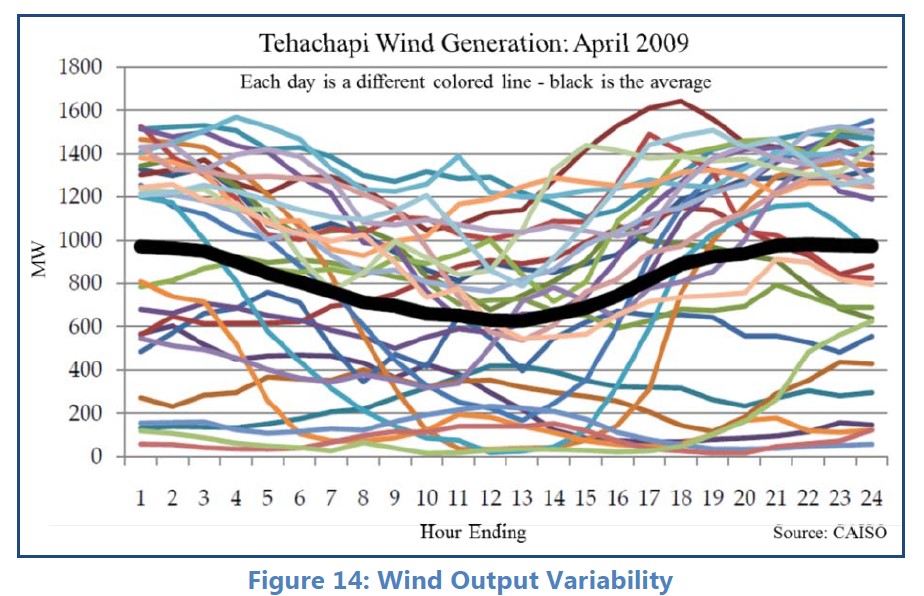

I’m sure forecasting available capacity from wind is amazingly accurate, but it is still a volatile resource per the following two charts. The first one shows hourly wind production from a wind farm in California. It reminds me of Sherpa fashion or a hand-knitted afghan my aunt gave me for graduation.

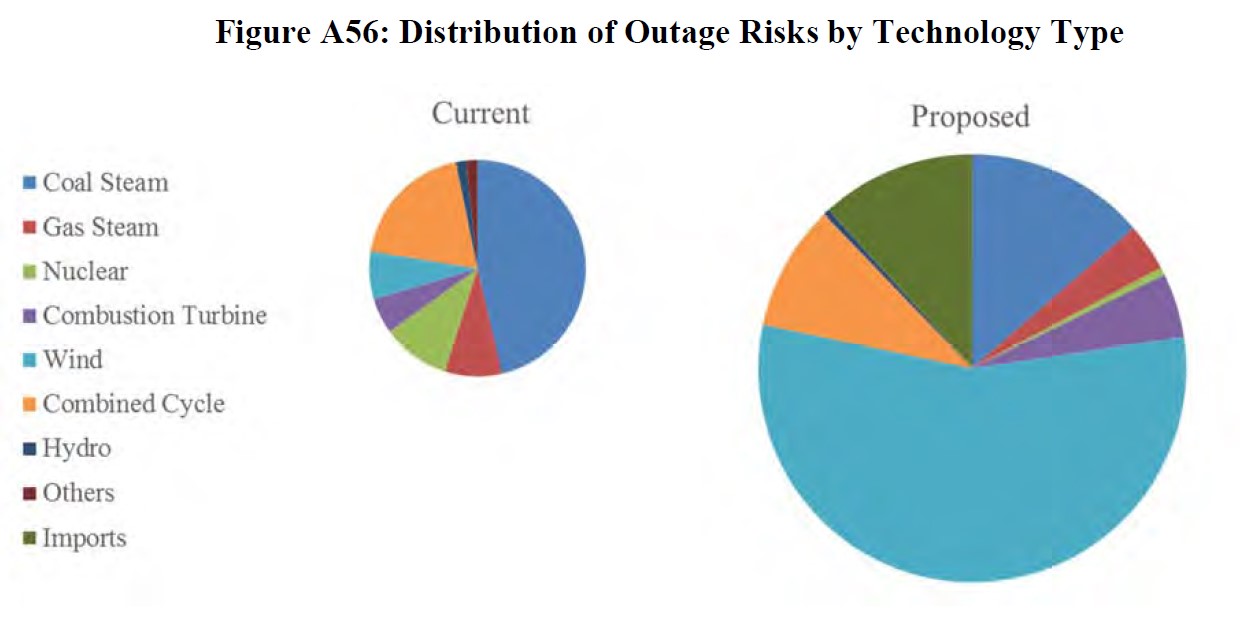

The second chart is again from the MISO report. Pie chart lovers, rejoice. The “Independent Market Monitor” projects a fourfold increase in risk. They say, “The volatility of wind coupled with significant forecasting error has created unique challenges.”

The second chart is again from the MISO report. Pie chart lovers, rejoice. The “Independent Market Monitor” projects a fourfold increase in risk. They say, “The volatility of wind coupled with significant forecasting error has created unique challenges.”

So we can see, there is a growing need for demand response in grid stability and reliability.

So we can see, there is a growing need for demand response in grid stability and reliability.

Economic

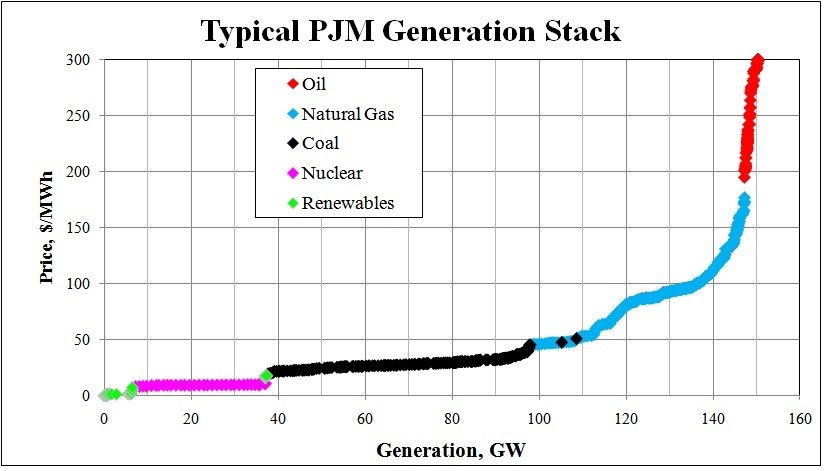

Finally, there are pure economic reasons for demand response. Demand is met through day-ahead auctions of supply-side resources. The cheapest resources clear first. Those are renewables with no marginal cost. Then we move to the next cheapest marginal cost – probably nuclear, and so on as shown in the chart below.

When costs get that high, it can be beneficial for the utility to deploy demand response in lieu of expensive power acquisition. Utility executives want to keep prices in a reasonable range. They make no money buying expensive power from some entity and passing the cost through to customers. Therefore, they pay customers to curtail. All customers pay for expensive supply, or all customers pay a few customers to reduce load.

When costs get that high, it can be beneficial for the utility to deploy demand response in lieu of expensive power acquisition. Utility executives want to keep prices in a reasonable range. They make no money buying expensive power from some entity and passing the cost through to customers. Therefore, they pay customers to curtail. All customers pay for expensive supply, or all customers pay a few customers to reduce load.

Next

We only got through some of the what, why, and how in this post. Next time, we will explore policies and demand response, particularly, the excerpt from the ACEEE paper quoted above.

[1] Say what? I’ll explain demand response later in this post. Keep going.

[2] Peak Load Management Alliance

[3] Constantly monitors the grid to meet instantaneous demand 24/7, 365 days per year.

[4] I’m making up my own terms here. Feel free to correct me.