We are taking a break from exergy this week, and we are going to examine what is happening in distorted electricity markets around the country. This will be somewhat of a sequel to Regulating Deregulation and Wind’s Other Big Subsidy. Too much of a good thing, or as they say, unintended consequences, is pushing the grid in some places toward instability. By the way, I scoff at the term “unintended consequences.” There are only two types of consequences: intended and ignorant ones.

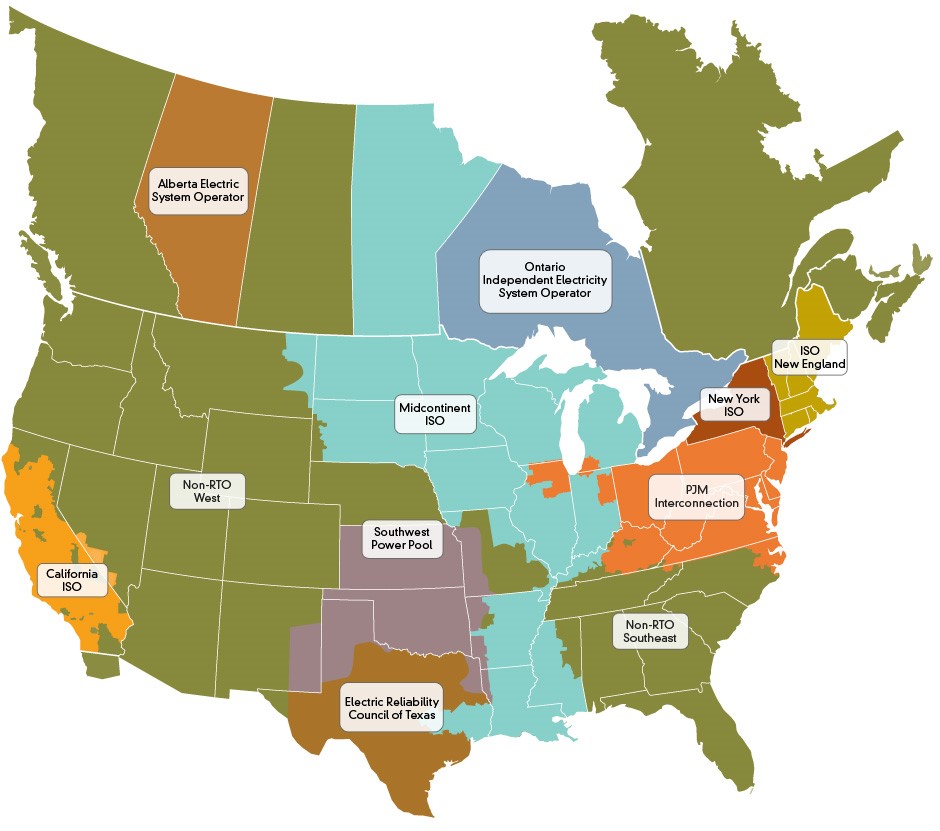

Utility Dive notes that Texas (Electricity Reliability Council of Texas – ERCOT) and the Southwest Power Pool are the only two system operators that have energy-only deregulated markets. According to the American Public Power Association, that is not entirely true. The California independent system operator does not operate a capacity market, which I presume means they have an energy-only market. Others including ISO New England, PJM Interconnection, and New York’s ISO have capacity markets.

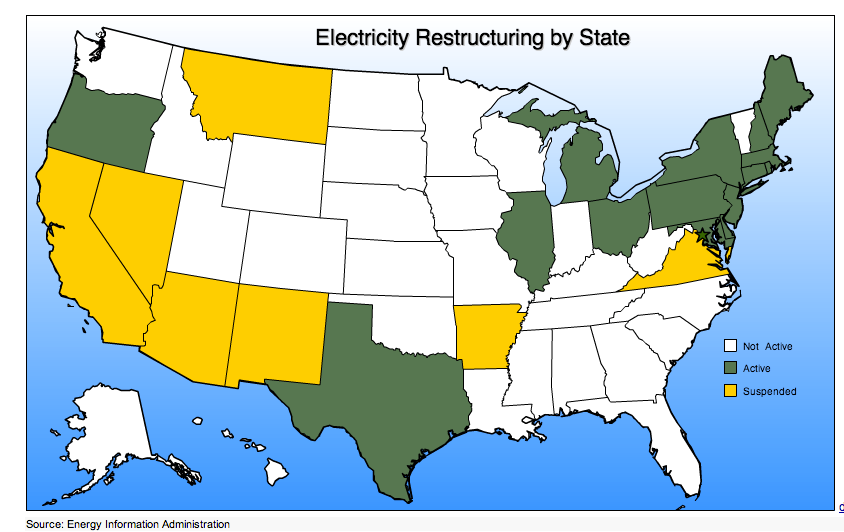

For comparison, state deregulation status and the associated regional transmission organizations (RTO) and Independent System Operators (ISO) are provided next to each other to the left. It is interesting that deregulation is not confined within a given RTO/ISO. For example, much of ISO New England is deregulated, but Vermont, which is within the ISO is still a vertically integrated market, apparently.

Capacity Markets v Energy Markets

According to Utility Dive, capacity markets ensure reliability by paying suppliers to commit generation for delivery years into the future. Energy-only markets pay generators only when they provide power day-to-day. What does that mean?

Texas’ electricity model has this thing called “scarcity pricing”, which would also be known as supply meets demand pricing, except with a price cap of $9 per kWh. I’d call it half pregnant Econ 101 pricing. The $9 prices are supposed to lure enough reliable capacity into the market to keep the lights on. However, as more yo-yoing wind comes online, the hours of $9 per kWh drop, making the addition of capacity look like a crumby investment to add reliable power supplies. There is no guarantee of price or duration of price to recover first cost and operating costs of supply resources. I will come back to wind’s role in this later.

The capacity market says if you produce power when I (ISO) need it, I will pay you $5.50 per kWh, plus $3.50 for the energy market for the same $9. This is for comparison only to match the $9 price. The message is the capacity market provides a price floor, plus the half-pregnant Econ 101 price. The ISO can project with load curves how many hours a given plant will be needed. They will dispatch resources in order of low to high cost. There may be a price guarantee when called, but there is no guarantee of the duration over which they can collect the guaranteed price.

Utility Dive states supporters of the energy-only model claim it is superior because it prevents consumers from paying for generation that is never needed. This too is not completely true. The energy-only market will not require consumers to pay a minimum price.

Wind’s Monkey Wrench

Dive says everything would be hunky dory in the energy-only model if it weren’t for the pesky federal government [and its push for production tax credits that give enormous advantages to wind energy]. But the same applies to capacity markets.

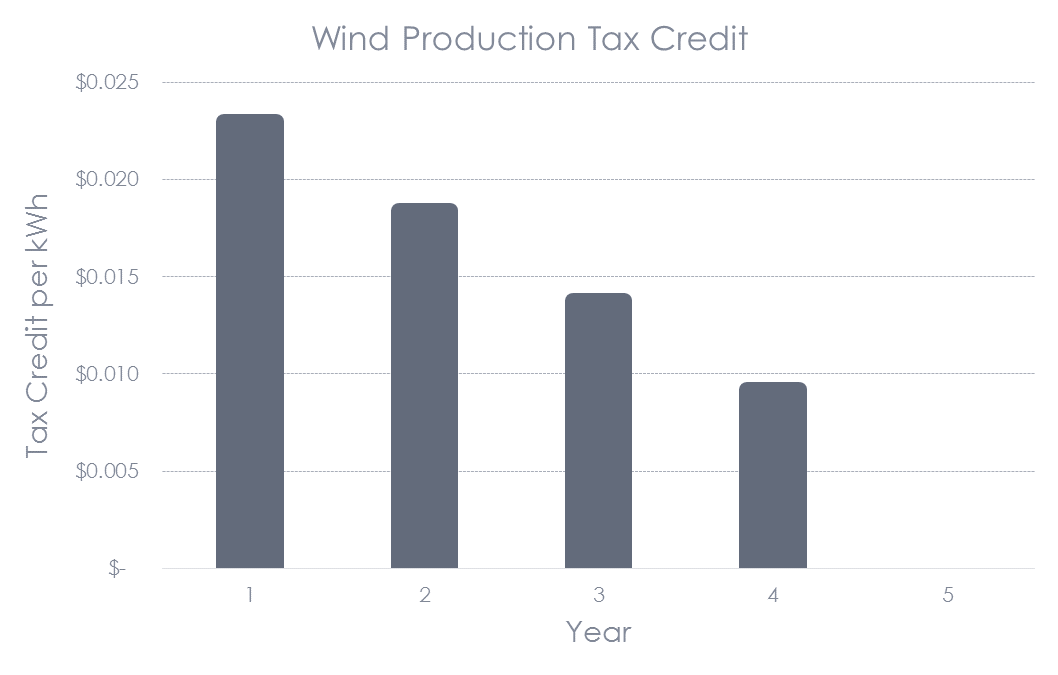

The production tax credit for wind, starting at 2.3 cents per kWh, drives prices into negative territory at times in certain areas. How does a reliable natural gas, coal, or nuclear plant compete with negative prices? They don’t. That is the problem long term. I suppose in the capacity market there is no guaranteed price because wind is not guaranteed supply. That is a big difference from Texas.

For a given wind turbine generator, the subsidy phases out over a few years, as shown below, and then the wind farm owner only gets what the market will bear. Then, instead of negative prices, the price is near zero. Woohoo. Cashin’ in.

In an interview with Public Utilities Fortnightly (PUF), Ben Fowke, Xcel Energy’s CEO, confirms what I’m saying. Xcel Energy’s overarching test for business policy is this: if the policy lowers costs for their customers, Xcel Energy will do it. This is consistent with regulatory policy anyway, and it makes for easy approval.

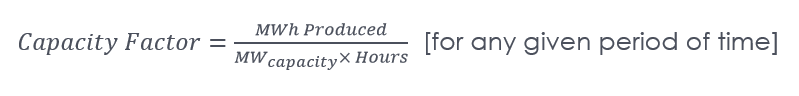

Steve Mitnick, PUF’s interviewer, asked Mr. Fowke to break down what happened to wind technology that made it as economic in recent years as it is now. Half the answer was that, yes, the technology has improved with larger blades and taller towers. Capacity factors, defined in the equation below, as a result, have improved from 30% to near 50%. That is indeed huge.

The second big reason is not technology, but the production tax credit. Like I always say, take what is given, even though it may be misbegotten policy. What is misbegotten? The cost of wind is smeared out nationwide by taxpayers, and in some cases, locally higher prices to subsidize prices from reliable conventional plants. In other areas, it creates a game of shifting goal posts, making the construction of dispatchable plants too risky.

Join the discussion 3 Comments