AMI, or advanced metering infrastructure, is rolling out across the land. This opens the door to a lot of cool things, including time of use rates, and it is a great enabler of electrification technologies.

I’ve heard from utility executives or people involved with some portion of demand-side management departments within utilities that smart meters are a waste of money. Wow. They are going to be standing at the depot while the electrification train is barreling forward. I will save that topic for another day. Stay tuned.

For background, here is a primer on AMI and here is a discussion of residential time of use and demand rates.

Last week, I wrote about the ingenuity of the electromechanical meter for measuring energy consumption in homes and businesses. While the device is a stroke of genius, it has one mode of communication; it must be read with human eyes, locally. The AMI device can log consumption or demand in short chunks of time, like every 15 minutes. This opens a huge world of benefits to utilities and customers, but regulators must come along for the ride.

Demand Response Review

Cheesy quiz warning. Demand response includes which of the following:

- Radio or pager control of air conditioning units

- Electric rates that vary with the time of use

- Demand rates that charge for peak power draw

- Interruptible rates that exchange bill credits in exchange for reducing power draw

- Remote control of smart thermostats

- Pleading with customers to save energy when it’s hot

- Taking advice from the utility and grilling the chicken outdoors rather than making a Thanksgiving meal indoors

- All of the above

After making this list, I learned it is a trick question. The FERC says money has to be involved. Demand response includes rage design, er rate design that incentivizes use during off-peak (or charges higher prices during periods of congestion) or provides direct payments for reducing energy use when asked.

According to FERC, the correct answers include A, B, C, D, and E[1].

Demand Charges

We’re going to examine demand charges and time of use pricing for residential customers. In Harpooning a Red Herring, I wrote that residential customers can understand the difference between demand and energy. For instance, stomp on the pedal of a Bugatti Chiron – its W16 engine consumes gas fast and produces 1500 horsepower. The total gasoline consumed is the energy consumed.

Time of use charges apply to hotel rooms and bars and restaurants. In those cases, you can charge what the market will bear in competition with others, or for the latter, you want to lure people in with hopes that they’ll stay and order more stuff later. Utilities charge for the cost of service, plus profit. This is described below.

Utility Profit and Prices

Utilities get paid for their investments including transmission, distribution, substations, and for vertically integrated regions like the upper Midwest, generating assets. The cost of energy is a pass-through. Even though customers are captive, utilities still want to keep average prices low. I’ll come back to the why on this.

A typical residential rate is 12 cents per kWh. What do I get for a kWh? A central air conditioner may burn through one kWh in 15 or 20 minutes. A kWh might also power a refrigerator for a day.

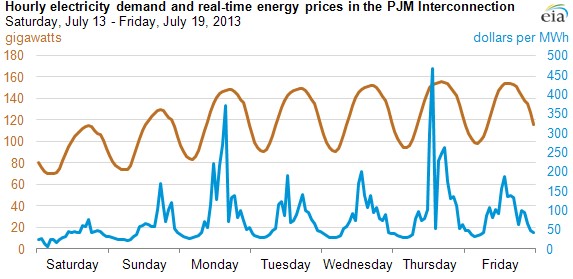

Even in regulated states, generators are brought online from the lowest bidder to the most expensive provider as demand for power rises. On the hottest Tuesday of the year, the utility may need to purchase electricity at $2.00 per kWh from a gas turbine burning jet fuel.

Throughout the year, the total cost of power purchased or generated by the utility is divided by the total kWh sold to result in something around 10.X cents per kWh, based on the 12-cent retail price noted. The rest is profit for shareholders. Customers are charged 12 cents whether it costs 2 cents or 200 cents for the utility. It all works out in the end, but you can see the lack of a price signal to the consumer.

Utilities want to maintain low prices for customers because regulators, who approve necessary rate increases, take cues from customers. They also want to keep rates low relative to other utilities in the state or region. This too enters into the subjective calculus of the regulatory mind.

Voila, lower average prices mean customers and regulators have a more favorable view and are, therefore, less resistant to getting desired rate cases (price increases) through when necessary.

How is that accomplished? Charge more to customers during peak times so they use less! Demand response! Customer-controlled demand response, as opposed to direct load control or interruptible rates, is made possible only through AMI. What if customers could get paid for using energy when prices are negative, and could save $100 during peak times? Of course, the flip side of this is, “Oops, I left the air conditioner on. There went the kids’ college fund layaway for the next couple months.” The rates we have today, even the demand rates, largely insulate consumers from these wild price swings, while still providing plenty of incentive to reduce during peaks.

Possibilities are endless. We will need to examine some options later.

[1] Only if accompanied by a monetary carrot.